The year ahead promises to be one where active managers will be rewarded for superior security selection as they navigate rising impairments across Australia’s high yield and private debt markets.

The devaluation cycle approaches

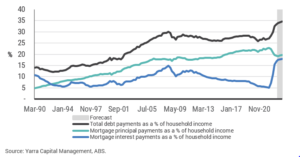

The RBA’s hiking of the cash rate by 125 bps through 2023 (to 4.35%) has jammed the brakes on economic growth (refer Chart 1), with ~1.8% GDP growth for the year largely attributable to higher immigration. Absent that ~2% population growth, Australia actually experienced a per capita recession in 2023.

Unsurprisingly, this rapid increase in interest rates has driven a significant increase in household debt servicing costs (refer Chart 1).

Chart 1: The devaluation cycle approaches

Despite the significant increase in household servicing costs and the widespread expectations of ~15-20% price declines, house prices have proven surprisingly resilient, posting six consecutive months of gains in 2023 and now back near their 2021 highs.

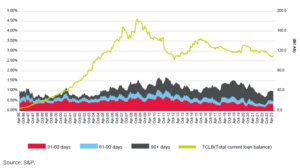

Fundamentally, gravity defying house prices reflect the post-pandemic resumption of high immigration which sees new housing demand and higher construction costs limiting supply. However, despite robust pricing and more acute financial pressures on households, prime mortgage arrears in the Residential Mortgage-Backed Security (RMBS) market remain very low and comfortably within historical averages (refer Chart 2).

Chart 2: Australian Prime Mortgage Arrears Remain Low

Of course, the employment market is the key to Australian households remaining solvent. While we do expect unemployment to rise from its current low (3.6%) to ~4.5% in 2024, this will not materially impact mortgage arrears or defaults.

Nevertheless, with mortgage repayments being prioritised, those other more discretionary parts of the economy could meaningfully underperform. Put another way, highly indebted businesses exposed to discretionary expenditures look particularly vulnerable.

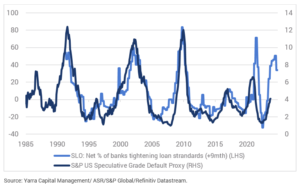

In the US, the significant tightening of lending standards augurs poorly for the High Yield outlook (refer Chart 3). While the US will typically account for a greater share of credit impairments, Australia’s high yield and private debt markets are unlikely to be spared.

Chart 3: Tighter Lending Standards Will Increase Private Debt / High Yield Defaults

With Australia having a less established high yield market, sub-IG private debt will fill the void. Overall, we expect a similar thematic here to offshore characterised by rising impairment risk across Australian private debt, particularly in mezzanine property lending and levered loans exposed to discretionary cash flows.

Mezzanine commercial property debt impairments will likely become more prevalent in 2024 as market forces weigh harder on valuations and debt serviceability. Discounts to NTA for listed REITs of 30-40% offer a preview. Extrapolating these pressures across the lower quality mezzanine private debt space suggests higher impairments are inevitable.

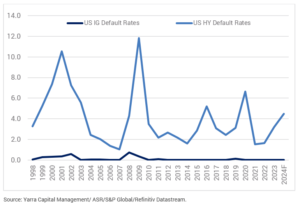

Conversely, there are no such impairment issues in the investment grade (IG) space, with defaults virtually non-existent across a number of cycles (refer Chart 4).

Chart 4: Benefits of Subordinated Debt from IG Issuers

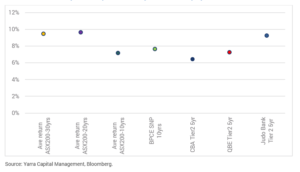

Outright IG yields are also very attractive, confirming the higher available risk-adjusted returns. As evidenced by more recent $A issuance, IG rated Senior and Tier 2 Bank and Insurance names (e.g. French bank BPCE, CBA and QBE) are offering attractive yields akin to 10-year average ASX 200 equity returns (refer Chart 5). So, IG yields are currently at longer term equity average levels but without the associated volatility and with significant potential to outperform as spreads and yields normalise over the medium term.

Chart 5: Recent credit yields compare favourably to historical equity returns

Attractive yields offer the prospect of higher returns and dependable and defensive income. At current yields, IG credit investors have levels of protection from negative returns last seen 15-20 years ago.

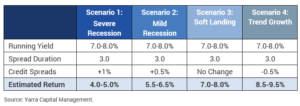

For instance, in a scenario we would deem a severe recession – where credit spreads widen by 100bps over a 12-month period (refer Table 1) – investors would still generate a healthy positive return of 4-5% on typical three years spread duration.

In fact, it would take a prolonged GFC style event – i.e., >+250bps widening in credit spreads over a 12-month period – to generate a negative return, the odds of which we deem to be infinitesimally small. We expect a soft landing (scenario 3) is most likely, with some small potential for mild recession (scenario 2).

Table 1: Estimated 2024 IG Portfolio Returns & Sensitivity Analysis For Yarra’s Credit Funds

Our Favoured IG Sectors for 2024

Tier 2 bank and insurance securities continue to offer outsized risk-adjusted returns and should continue to sustain carry and generate capital growth as spreads normalise. For instance, the recent BBB+ rated Westpac 10nc15 Tier 2 issued at a very attractive 7.2% (+240bps credit spread).

RMBS remains another favoured sector, where credit spreads had effectively doubled in 2022 and are only now starting to normalise across senior and mezzanine tranches. From our perspective, buying AA-BBB rated RMBS tranches at yields of 7-9% with near bulletproof collateral protection remains incredibly attractive.

One sector of focus in corporate bonds is the A-rated REITs, with many viewing the sector’s recent underperformance as a buying opportunity for 2024. Despite now trading in line with BBB-rated corporates, we are not so sure A rated REITs – particularly those with substantial office portfolios – are a buy, with our internal rating for many of these REITs a notch or two below the rating agencies. We deem many of these bonds to be at best fair value, with significant potential for further volatility in 2024 as the devaluation cycle plays out.

Overall, 2024 promises to be a year of clear winners and losers where active managers will be rewarded for superior security selection. We expect to see some High Yield impairments impact the market and for the superiority of IG credit vs. higher yielding private debt to be re-established, with yields akin to equity market averages.