Entering the final months of 2019 a renewed sense of optimism has crept into global markets. From Tim Toohey’s perspective, excessive pessimism has dominated markets in recent months, so the market response is thus far best interpreted as a removal of pessimism rather than reflecting excessive optimism.

In our latest whitepaper, Reflation, a liquidity driven turning point for the global economic cycle (download here), Toohey, Head of Macro and Strategy:

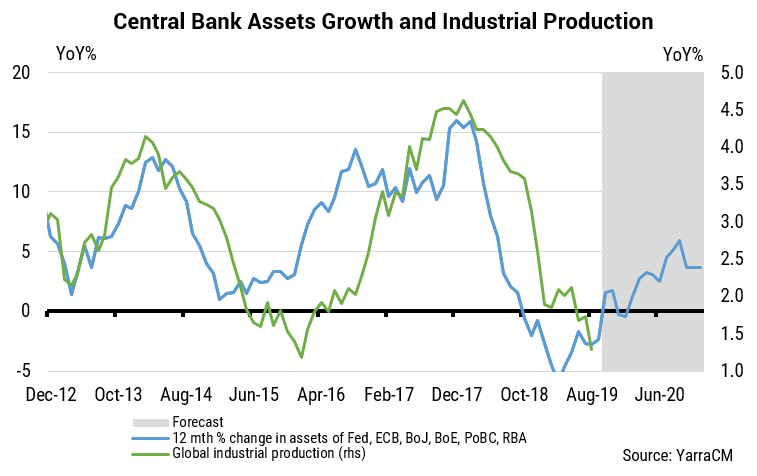

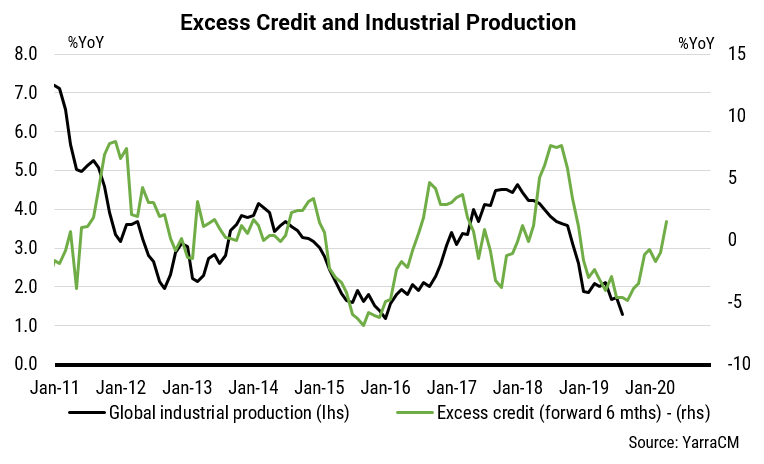

- Assesses the evidence of the global recovery recorded to date;

- Re-interprets the causal factors behind the recent slowdown; and

- Illustrates what some of our preferred proprietary leading indicators are suggesting for how the recovery could evolve.

The conclusion is a surprisingly upbeat global growth signal which may highlight some portfolio construction challenges for Australian based investors.

So what does this mean for Australia?

For a nation that remains at pointy end of shifts in the global economic cycle, the A$ is likely to be one of the prime expressions of improved global industrial growth. Not only could a more positive global industrial cycle prompt a shift from defensives to global cyclicals and value sectors, but it should also prompt a reassessment of companies with US$ earnings.

Few of us can remember the last time Australia managed to run Federal Budget and Current Account surpluses in tandem, let alone when this has occurred at the trough of the global industrial cycle. Yet that is exactly where Australia finds itself at the end of 2019. If there is to be a surprise for local managers it is that the A$ appreciates at an uncomfortable pace in coming months, even as geopolitical uncertainty remains high into the US election year and as the threat of RBA embarking on its own QE journey looms in the background.

In short, prior reflation periods suggest the best exposures include:

- Long equities in general and EM equities in particular

- Long base metal commodities v short gold

- Long A$, KRW, CNH and NZ$ v US$, JPY, and CHF

- Short DM bonds and steeper yield curves

While the amplitude and duration of the reflationary impulse is likely to be shallower and shorter than prior cycles, given our understanding of current positioning amongst global investors, it is a thematic that will prove difficult for investors to ignore.

A copy of Tim Toohey’s whitepaper can be downloaded here.