As markets squeeze up to ever-more stratospheric heights, benchmark-aware investors are often confronted with two choices: follow momentum and chase performance/control risk or persevere and maintain conviction.

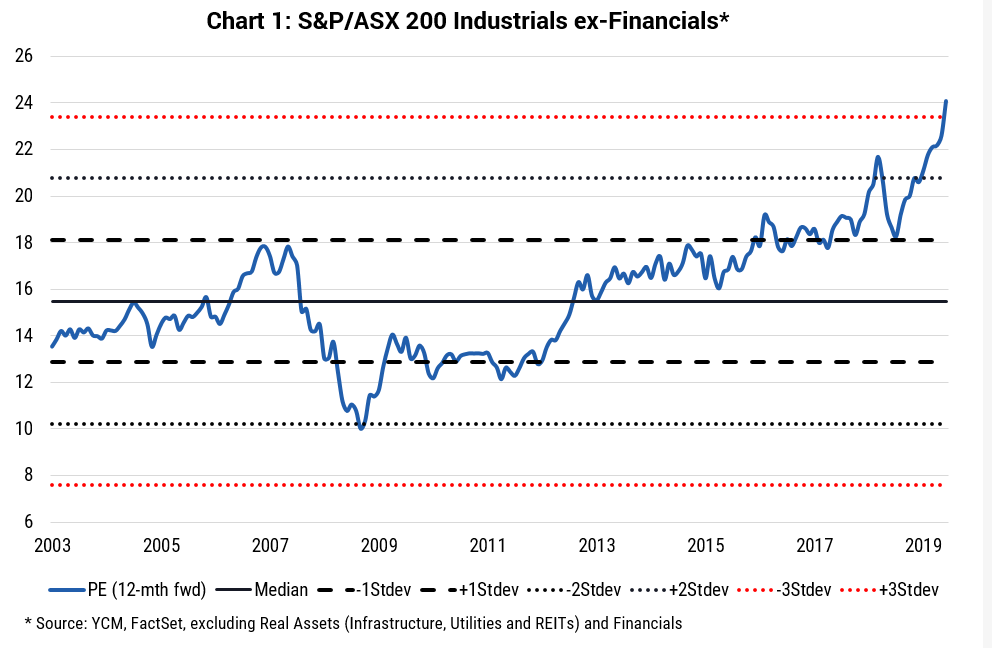

In 2019 the former option has worked pretty well while equities globally rose to record levels (the ASX 200 hit an all-time high at the end of November). As such it is no surprise to see the Industrials ex-Financials now trading at over 24 times (refer Chart 1), more than three standard deviations from its historical average, despite only ‘growing’ earnings by -2% in FY19 and forecasts for just +5.4% growth in FY20¹. It has appeared for some time valuation discipline has taken a back-seat, with 200 day moving averages being of greater interest.

But one sector’s recent performance – gold – should draw attention to the perils of this approach:

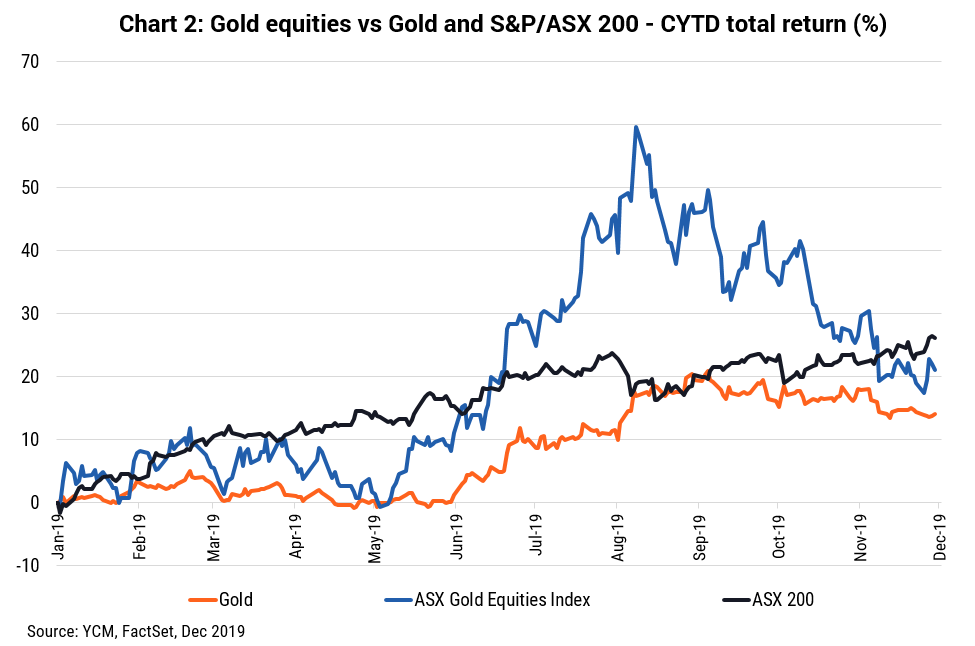

- From January to mid-August the gold price rallied +17% to above $US1,500 per ounce, gaining favour in its role as a hedge for uncertainty. Forecasting the gold price in the short term has more in-common with astrology than financial analysis, as such we can’t be that surprised

- Australian gold mining equities dramatically overshot the commodity over that same period (refer Chart 2), with their +60% rally making them 45% more expensive than global peers

- Gold equities became a large part of benchmarks: 3.3% of the ASX 200, 8.2% of the ASX 300 Ex-20 and 9.0% of the Small Ordinaries Index, creating performance/benchmark risk for active investors which in turn created a feedback loop for buying gold equities

- From mid-August performance started to reverse, with gold equities subsequently falling 24%. The catalyst for the fall wasn’t obvious then and isn’t particularly obvious now

For investors who ignored stretched valuations and entered gold positions to counter the sector’s growing influence on benchmark returns, the penalty has been harsh.

There are a few sectors which appear vulnerable to an unwind in momentum, including Consumer Staples (e.g. WOW, COL, TWE, A2M) and Health Care (e.g. CSL, COH). Both comprise a large part of the ASX 200 (at 6% and 9% respectively) and trade at sharp premiums to historical valuations² (at +48% and 64% respectively on a P/E basis).

We remain -580 bps underweight Staples and -510 bps underweight Health Care, recognising that while timing may be difficult to determine, the risks/reward at these levels is distinctly unfavourable.

1 Source: Goldman Sachs

2 Source: Calculated as the monthly 12-month forward P/E from 30 Jun 2001 to 30 Nov 2019