The Future Quality approach to navigating uncertainty

Key takeaways:

- We are currently in the midst of a regime change to a world of slower growth, periodic bouts of inflation, and technological transformation.

- While much of what the future holds is unknown, such as the impact of artificial intelligence (AI), other clear long-term trends can help guide investors: the path to clean energy, growing healthcare requirements, and the re-emergence of the travel industry.

- Our focus on Future Quality companies, that have been shown to deliver better performance over time, helps us identify the market leaders of tomorrow.

“There are things we know we know. We also know there are known unknowns; that is to say, we know there are some things we do not know.” Donald Rumsfeld, former US Secretary of Defence

The great quantitative easing experiment of the last decade set global markets on a course into unknown territory. The repercussions of this are only just starting to play out and are proving near-impossible to predict. Central banks contended a rise in inflation would be temporary until it proved to be persistent and sticky. At the start of this year, markets were collectively expecting the US Federal Reserve to start tapering monetary policy, but we cannot yet be certain that interest rate rises have peaked. Earlier in the year, America’s banking sector was unexpectedly impaired by the impact of rapid monetary tightening, but could other sectors also be vulnerable to unforeseen shocks? And we are yet to truly see the impact that central bank actions will have on growth. The major economies have so far avoided falling into recession, but for how long?

Market dynamics reflect this sense of uncertainty. US equity returns have largely been driven by a cohort of seven mega-cap stocks during the first half of the year, a narrow leadership anomaly that is crowding out good performance in other parts of the market. And anyone on the wrong side of this trade has felt the impact of underperformance.

So how should investors be navigating this sea of uncertainty?

Known knowns

At a time when investors are facing many unknowns, it is almost impossible to accurately predict the future. Yet, despite this ambiguity, there are still knowable knowns to be found.

Previous market cycles have taught us that major shifts in the economic landscape generally lead to changes in leadership. So, we must focus on what we know to help identify those sectors and industries capable of taking up the position of market leaders in the forthcoming cycle.

Fortunately, there are several clear and indisputable trends.

The path to clean energy

An energy transition will be key to solving the major social and environmental problems caused by climate change. We know there is a need to reduce humankind’s reliance on fossil fuels and create better alternatives through renewable sources of energy. Despite this knowledge, the journey is not straightforward. Paradoxically, given the time it will take to develop the necessary scale of new clean energy sources, we remain reliant on fossil fuel supplies; yet supply constraints have driven up prices, making the transition process even more costly. So, while the general sentiment is that we need to invest in renewable energy sources, continued investment in fossil fuels can be vital to enabling the energy transition.

This creates a fruitful pool of investment opportunities where individual companies offer solutions to both sides of this equation. On the one hand, some services and providers can help sustain fossil fuel production more efficiently, while still considering lower carbon outputs. On the other, technology is emerging to deliver more renewable solutions, and innovations in both hardware and software are helping reduce energy usage, waste, and the scale of emissions. Market leaders in all these areas are likely to surprise in terms of margins and profitability, and therefore present classic future growth opportunities.

Growing healthcare requirements

Healthcare presents a second long-term, structural trend. An ageing global population will only result in greater demand for healthcare while, at the same time, the sector faces increasing challenges in terms of its affordability. In our view, this demographic test will present a great hunting ground for investment ideas as healthcare companies are forced to innovate to ensure more efficient delivery of healthcare services, both in the hospital environment and through consumer-led healthcare solutions.

In the post-pandemic era, the healthcare sector has faced further volatility amid the disrupted labour market for staff, while inventories have needed to be replenished from the high demand necessitated by Covid-19. These challenges are starting to stabilise, and we are optimistic about the sector’s ongoing potential due to the 3 • yarracm.com clear need for innovation in the provision of new and more efficient healthcare solutions.

The resumption of travel

Finally, travel is perhaps a less obvious trend, but it’s one we believe is worth exploring. The pandemic was a huge challenge for the sector, with many people under-consuming travel services simply because they were not allowed to travel. In terms of supply, the lack of demand meant the availability of flights and the development of hotels completely dried up for a period. While many consumer activities have completely normalised, travel is very much still in the process of recovery. When you look at the core consumers of travel, demand remains robust. This is particularly true for younger generations, who are placing even greater value on ‘experiences’ during life after lockdown.

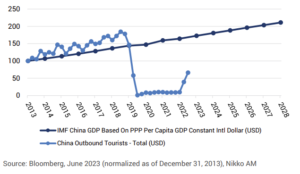

Further, a new travel cohort is emerging from developing countries where rising gross domestic product (GDP) per capita means more people will be able to afford to travel in the future. This reflects the same growth trajectory that developed nations have already experienced in recent decades. In our view, there will be many direct beneficiaries of this significant return to global travel, from booking companies to manufacturers of luggage and travel accessories.

Chart 1: Is there a China travel boom pending?

Addressing the known unknowns

While the investment case for established trends is relatively straightforward, it can often be harder to assess when or if an emerging trend will become a longterm investible opportunity.

AI presents an interesting example of this conundrum. While research in this area can be traced back to the 1950s, it has only recently become a commercial opportunity in the eyes of many investors. The market has quickly latched on to this development, and excitement over its potential has seen the limited number of direct AI players re-rate significantly – hence the dominance of the technology mega-caps so far this year.

Although we have few doubts that the AI theme is both real and profound, there are still many unanswerable questions. The profits and cashflows from AI are yet to materialise, so it’s hard to be certain that they will be strong enough to justify current valuations. The adoption of AI is likely to have a meaningful impact across multiple industries – just as the internet did in the early 2000s – but it is difficult to identify who the eventual winners and losers of this disruption will be. There will also be geopolitical implications – the need for specific policy and regulation is already being widely debated.

While we can see the investment potential of having exposure to AI, it needs to be done in a way that’s consistent with our Future Quality philosophy of focusing on the knowns rather than blindly following the hype. A raft of companies are benefitting from the rising tide of AI, but only hardware companies are currently seeing any tangible uplift in cash flow and profitability – which is what we are looking for. As more companies look to harness AI’s potential, we expect to see strong long-term demand for the complex high-end semiconductors that underpin this technology. For example, Synopsys – a leader in design technology and services for the semiconductor market – could benefit strongly as companies’ demand for exceptionally complicated design services grows. Similarly, Hoya is a leading supplier and manufacturer of high-tech components used by semiconductor manufacturers and should be a beneficiary of increased demand.

Future Quality in the Year of AI

While it’s impossible to know the ultimate direction of travel, we do know that we are in the midst of a regime change to a world of slower growth that will endure bouts of persistently higher inflation. It is also a time of significant technological transformation that not only encompasses AI but will drive the energy transition and provide new healthcare solutions.

History tells us that during such inflection points, companies delivering high growth and sustained high returns of basic capital – classic Future Quality companies – earn the right to be market leaders and that these companies may come from different areas of the market to the leaders of the previous cycle.

As investors, we believe it’s essential to stick to what we know, particularly during times of unpredictable change. Our investment approach is focused on identifying and investing solely in Future Quality companies, those with superior long-term returns on investment that have been shown to deliver better performance over time.

In our view, it is these Future Quality companies, especially in sectors aligned with secure, long-term trends, that will be the market leaders of tomorrow.

For more information on the Yarra Global Share Fund and if you would like to add it to your clients’ portfolio, please contact our distribution team.

The Yarra Global Share Fund is invested in the Nikko AM Global Equity Fund managed by the Global Equity Team of Nikko Asset Management Europe