For Phil Strano, Portfolio Manager of the Yarra Absolute Credit Fund, having the ability to access fixed rate securities for a floating rate portfolio remains a key competitive advantage for Yarra and highlights the strengths of the Fund’s multi-sector approach.

Following a stellar 12 months, investors are well within their rights to ponder the direction of future credit performance. For instance, while the Yarra Absolute Credit Fund generated a strong 7.3% return [1] , we’ve been on the record that we expect these returns will moderate somewhat back to a level more akin to Cash+300bps.

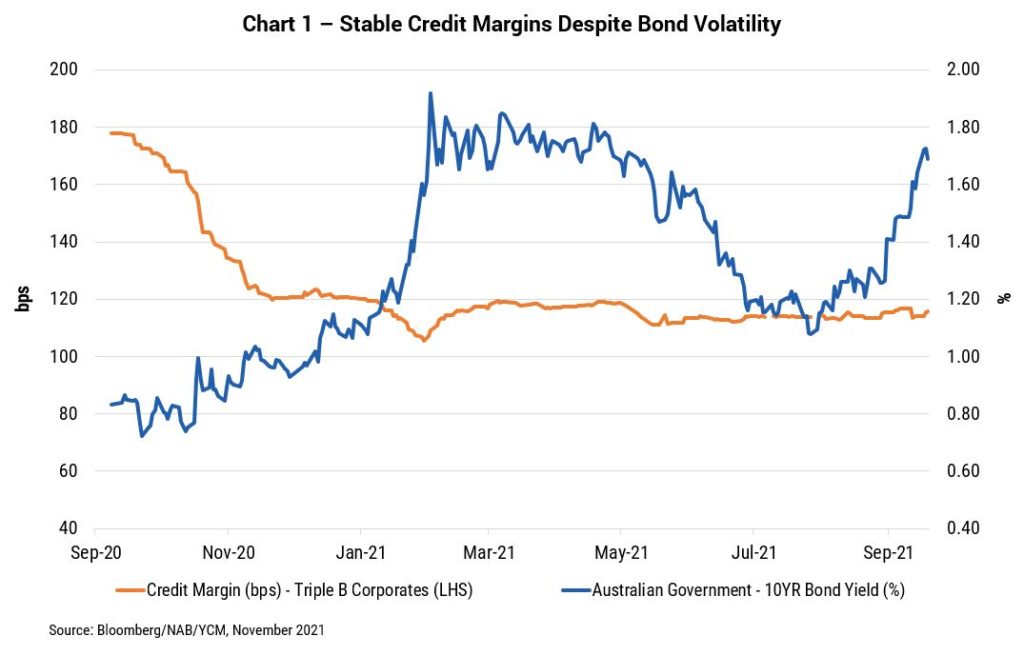

Confidence in our ability to generate strong returns over the next 12 months is premised on several factors. Firstly, despite recent volatility associated with the potential emergence of inflation and very volatile government bond yields, corporate credit margins have pleasingly remained broadly range bound throughout 2021 (refer Chart 1).

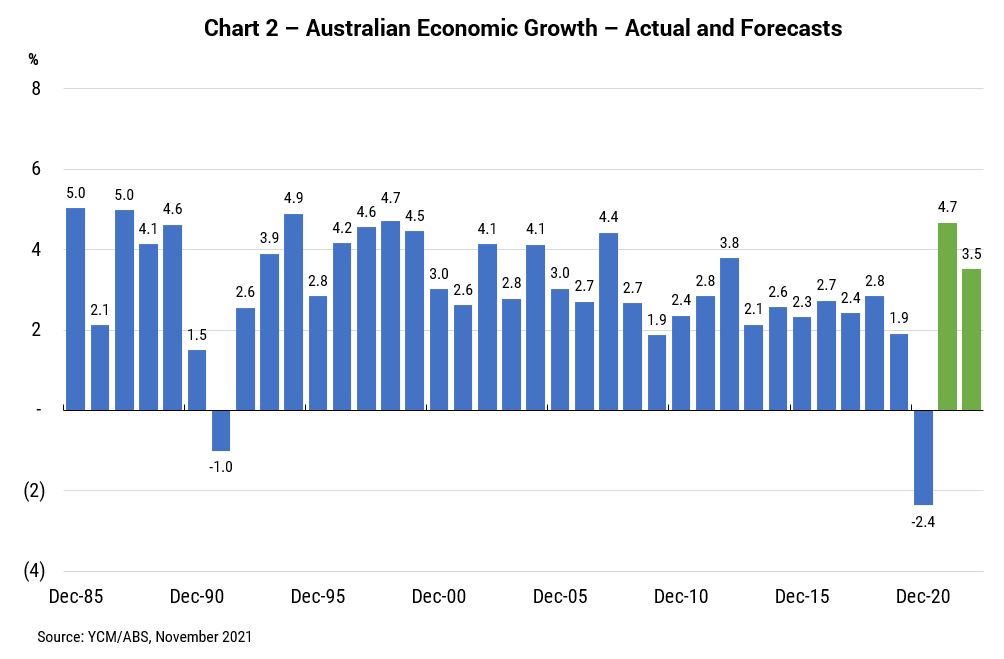

Much of this solid income performance in credit is due to the positive economic backdrop, with high economic growth forecast for 2022 expect to maintain credit’s attractiveness (refer Chart 2). While economic conditions remain supportive, investors will want to continue to boost their returns by continuing to earn the margin over government bonds.

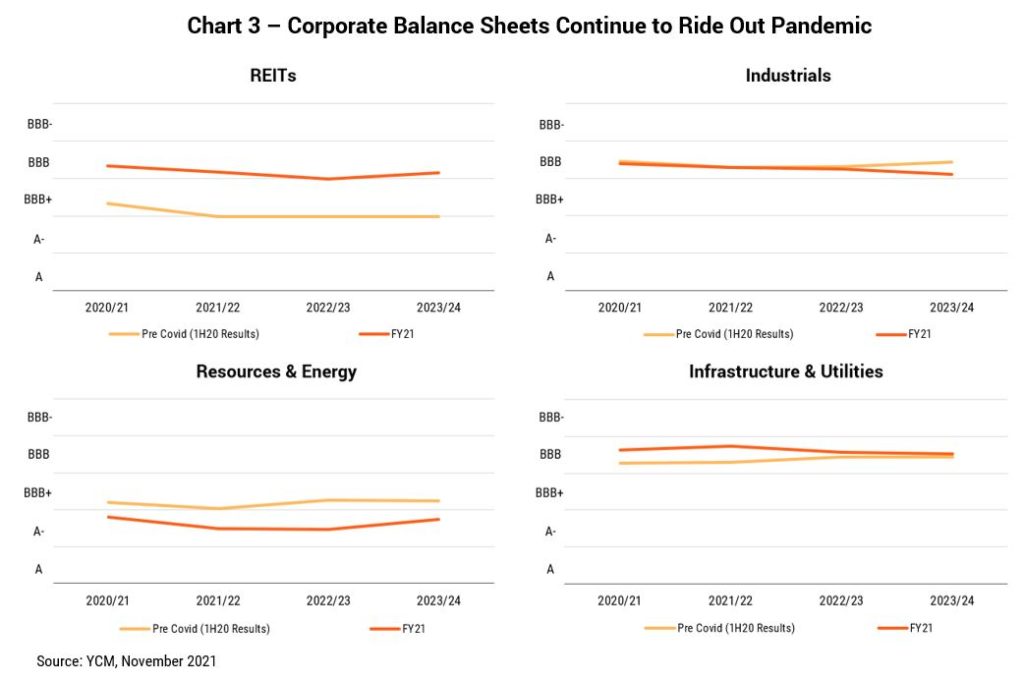

Moreover, strong corporate fundamentals also remain supportive of continued allocation to credit. Credit quality in most sectors is at, or above, its pre-COVID levels, buttressed by government/central bank stimulus and the action taken by management teams to de-lever balance sheets in 2020 (refer Chart 3). For REITs, which have experienced mild credit quality deterioration in since COVID’s onset, wider credit margins largely reflect this increased risk.

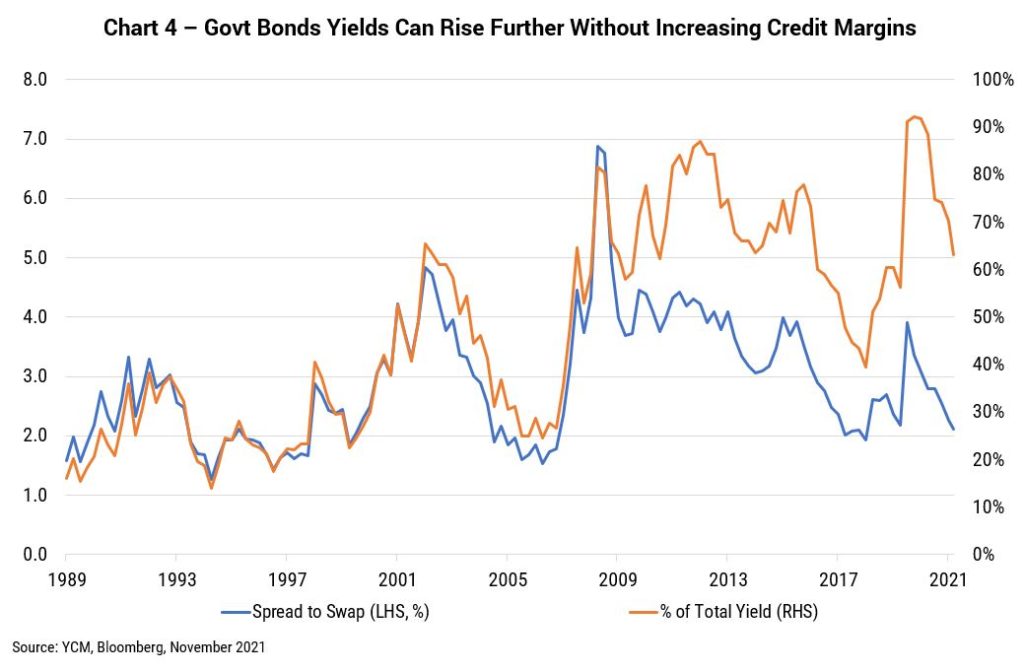

Finally, it is worth examining the correlation between credit margins and government bond yields, with investors often focused on potential rotation from credit into government bonds as yields rise leading to a period of underperformance. Looking at US data dating back to 1989 for triple B credit margins and as a % of total yield (including government bond and swap yields), it is clear that in addition to credit margins being tighter throughout much of the 1990s and during the 2004-2006 periods, credit returns also accounted for just ~10-30% of the total yield compared to ~60% currently (refer Chart 4).

We believe these statistics should provide comfort to credit investors: government bond yields can rise much further and easily account for a greater percentage of total yields without impacting credit margins, providing the economic backdrop continues to remain robust like much of the 1990s and the 2004-2006 period (our base case).

Turning to the broader portfolio, whereas 2020 presented countless opportunities for higher risk-adjusted returns, opportunities in the back half of 2021 have naturally become more selective. One area we see as particularly attractive at present is adding spread duration to take advantage of the yield curve’s present steepness.

Over the course of 2021, we’ve added between 0.5-1 year to spread duration, investing in longer dated investment grade corporates such as the 10-year Pacific National (BBB-) and Melbourne Airports (BBB+) bond, at attractive yields of between 3.5-4.5%. Hedging out the interest rate risk, we are generating a floating rate return from these assets comfortably above our hurdle rates over cash and with minimal credit risk, protected from any further increases in bond yields and improving the portfolio’s credit quality.

Being able to access fixed rate securities for floating rate portfolios remains a key competitive advantage for Yarra, and highlights the strengths of a multi-sector strategy such as the Yarra Absolute Credit Fund. The Fund is well placed to continue delivering stable income, with a running yield of 3.75% [2] from its average investment grade portfolio, a yield to maturity above 4%, and capital which remains protected from rising interest rates.

[1] For the 12 months to 31 October 2021 (gross).

[2] As at 31 May 2021.