Roy Keenan, Portfolio Manager of the Yarra Enhanced Income Fund, details what higher inflation and rising interest rates mean for his floating rate portfolio.

Looking at the year ahead, it will be fascinating to see how the economic landscape at home and abroad evolves. Hopefully it centres around moving from the current omicron inspired shadow lockdowns/restrictions in various jurisdictions to, dare I say it, Vaccine boosted and “RAT” enabled re-openings.

Current difficulties aside, re-openings around the globe have combined with still ample fiscal stimulus and pandemic related supply side constraints to drive a resurgence in inflation. While many suspected higher inflation, especially in the US, would prove transitory in nature, there is now a growing consensus this may not be the case with the Federal Reserve (Fed) now bringing forward QE tapering and potentially increasing interest rates four times through 2022.

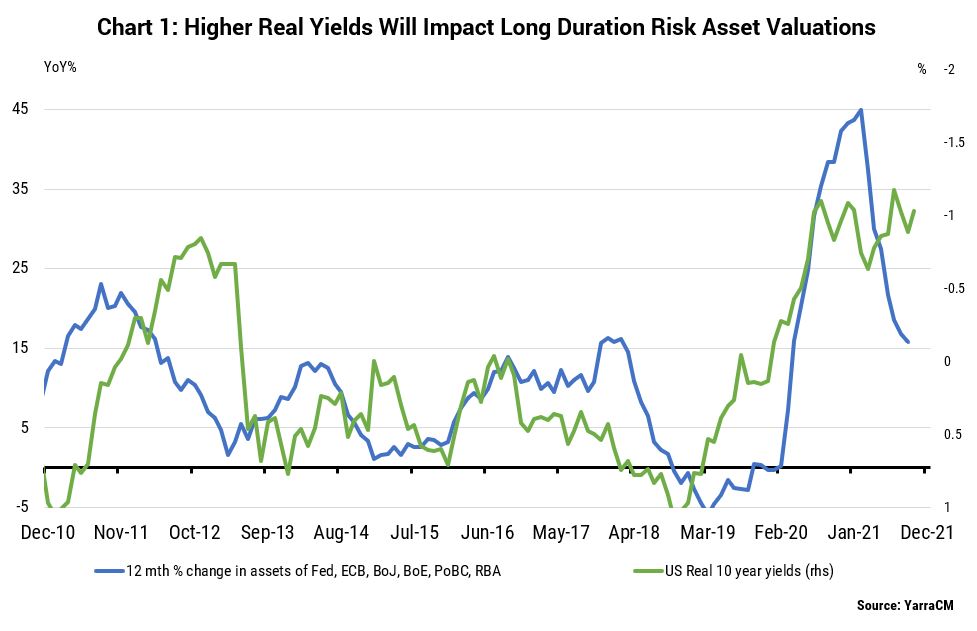

Investors now face a myriad of challenges. For asset markets, the realisation that current inflationary impulses are not transitory may prove problematic for long interest rate duration portfolios, with a rise in real yields expected to follow tapering by the Fed (refer Chart 1).

Any rise in real yields is likely to impact the value of everything long interest rate duration, from traditional fixed income to most equities. Not so floating rate credit, however, since its short duration offers protection to portfolio valuations from rising interest rates. Moreover, given a robust economic backdrop in 2022 (refer “Both Sides Of The Credit Story”), we also expect credit margins to remain relatively stable throughout, adding to floating rate credit’s income generating credentials.

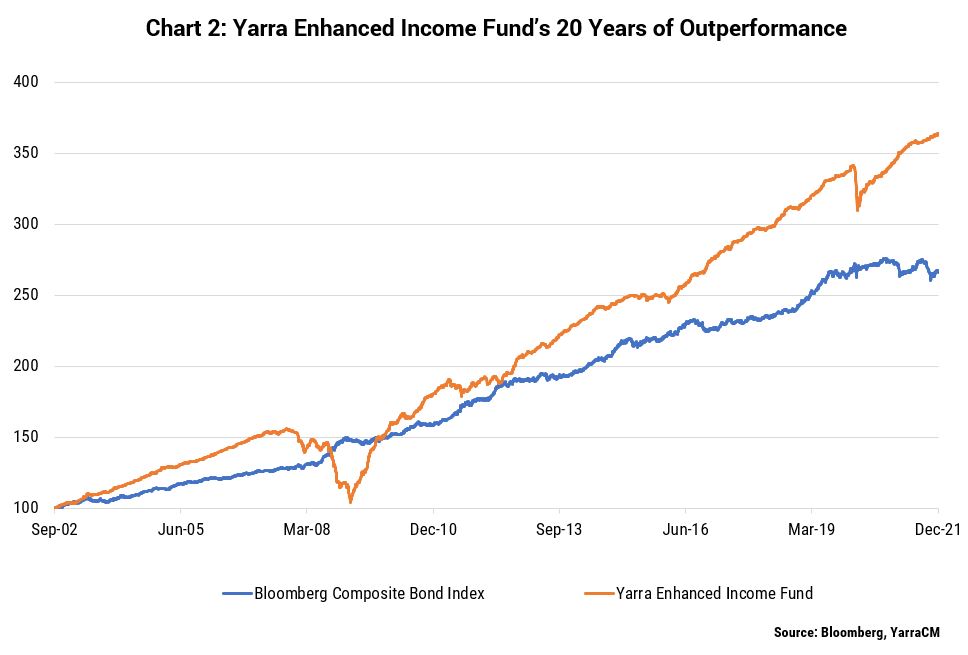

Putting this into contest, from February 2020 and despite the drawdown experienced in March 2020, the floating rate Yarra Enhanced Income Fund (EIF) has outperformed the long interest rate duration Bloomberg Composite Index by ~6%, a thematic we expect will continue in 2022 as interest rates move higher in a post-pandemic world of higher growth and inflation.

Looking back even further, EIF’s ~20 years of outperformance is even more impressive (refer Chart 2), delivering 277bps p.a. of excess return[1] over cash and never missing a unitholder distribution (paid monthly).

Of note, two recent investments exemplify EIF’s enduring strengths in targeting higher risk-adjusted returns. We recently locked in higher returns from June and September 2022 bank bill contracts, given our expectation the RBA would not significantly increase rates until late 2022. We also increased our exposure to Crown’s subordinated notes (CWNHBs) on an improving ESG story and continued strong asset coverage. Following an advantageous regulatory finding and a subsequent takeover offer in November, the CWNHBs capital price has increased 11% from its October lows.

For the 12 months to 31 December 2021, the Yarra Enhanced Income Fund delivered a total net return of 5.19%[2] (including a 3.32%* distribution return), comfortably exceeding its cash rate benchmark which returned 0.10%.

0 Comments