With the post-COVID economic recovery exceeding expectations, Dion Hershan, Head of Australian Equities, looks at the potential return of cyclical companies.

As the market grapples with the prospect of higher interest rates, what we are now observing in the equities market is more normal than abnormal. But for investors too young to have experienced business cycles, or those carrying a significant recency bias, it will likely represent a shock.

The unwind of these market conditions could prove painful for some investors, but a massive opportunity for others. The starting point (prior to Nov-20 when Pfizer announced its vaccine was highly effective) is extremely relevant:

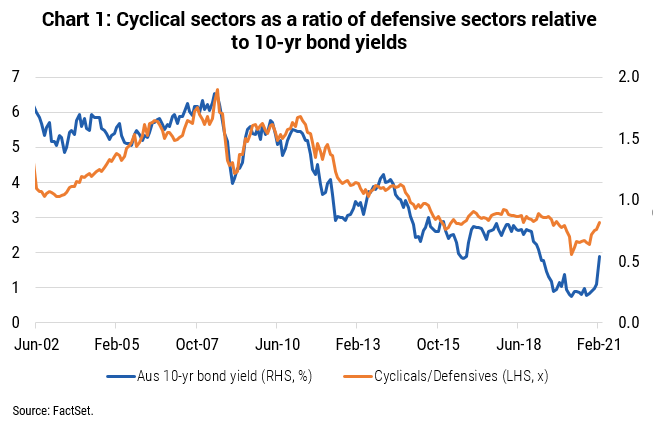

1. Cyclicals had underperformed defensives by 1,079 bps p.a. (283% cumulative) as the Australian 10-year bond yield fell from its peak of 6.78% in Jun-08 to 0.83%[1]. Basically, throwing darts at healthcare or tech stocks would likely have seen strong returns. Since Nov-20, though, this trend has begun to reverse, with cyclicals rising +24% and defensives falling -3% alongside higher bond rates.

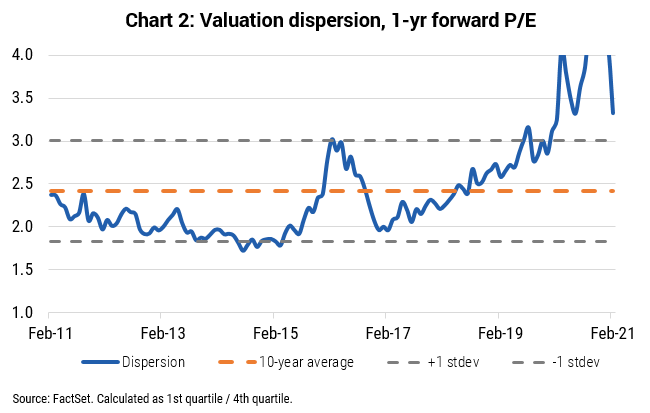

2. Valuations for high-growth companies were literally off the chart, having risen to as high as 51 times 12-month forward earnings, largely due to falling discount rates. They remain elevated at around 40 times – well above the 10-year average of 26 times.

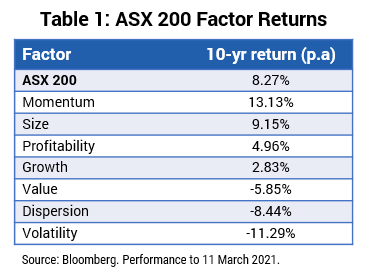

3. Momentum as a factor has been relentless, returning 13.13% in the past 10 years vs the ASX 200’s 8.27%. In the depths of COVID, ‘high momentum’ stocks (Tech, Health Care, select Retailers and Gold) outperformed ‘low momentum’ stocks by as much as +15%[2].

While it’s difficult to call the outlook from here, what we have seen suggests Nov-20 isn’t merely a blip, given we have seen:

- A very strong V-shaped economic recovery: we expect Australia to deliver real GDP growth of 6% in 2021, above the global forecasts for 5.5% and faster growth than any G7 country; and

- The best reporting season in a decade: 3.2 times more companies beat estimates than those that missed and EPS and DPS guidance was revised up for the full year, providing vindication that there is still life in cyclical businesses.

With the rapid recovery exceeding expectations, we believe inflation and rates will continue trending higher. Such an environment is ‘opportunity rich’ for active investors, and we believe our strategies are well positioned for this environment. We have built stakes in a number of cyclical companies over the past few months including Lendlease (LLC), Iluka Resources (ILU), Alumina (AWC) and Mirvac Group (MGR), and continue to remain underweight high P/E names such as CSL (CSL) and Afterpay (APT).