Companies frequently talk about taking out costs, boosting productivity and just simply removing ‘fat’ and avoiding ‘cutting into the bone’. Dion Hershan, Head of Australian Equities at Yarra Capital Management, shares some of the team’s observations from reporting season.

While February 2017 reporting season has been viewed favourably by the majority of commentators, our appraisal has been far more circumspect (bordering on downbeat). Stunning results for the Resources sector (16% of the ASX 200) off the back of surging (but unsustainable) commodity prices helped mask anaemic growth in other sectors, providing further evidence of an economy (ex-housing) that’s limping.

Our team met with more than 150 companies in February and a common thread was that many have simply pushed too hard on costs and have ‘cut into the bone’ in an effort to compensate for five years of weak top-line revenue growth (Industrials revenue growth was 4% this half, probably only ~2% of which was organic).

Examples of some companies pushing too hard included:

- Profit downgrades – Spotless, Primary Healthcare, Brambles, Flight Centre;

- Weak revenue growth, often a consequence of under-investment and cost reductions – Telstra, Tabcorp, Medibank; and

- Accounting games – countless companies either impaired assets (helping future margins but with zero impact on cash flow), changed tax rate assumptions or reversed bonus accruals

An interesting reporting season sidenote has been the number of CEOs of successful business that have chosen to retire now. Experience tells us these ‘ baton changes’ (which often turn out to be hospital passes!) frequently prove to be the top of the business cycle for these companies and are worth watching closely. Best of luck to the incoming chief executives at Ramsay, Aristocrat and Brambles.

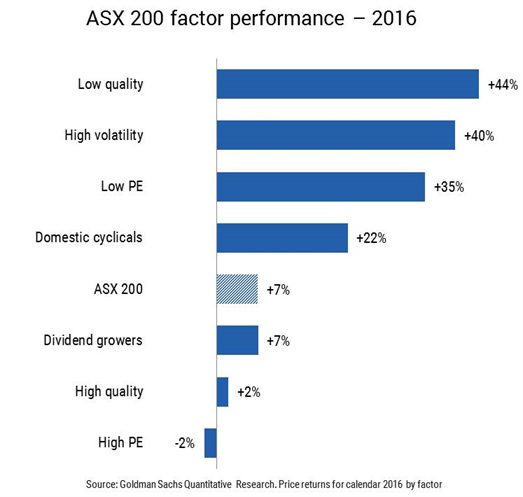

As investors with a sharp focus on ‘financial sustainability’ (ESGF, if you will) we remain cautious on companies promising ‘productivity gains’ at this point of the cycle. In a market where there appears to be a late stampede into value stocks and cyclicals – refer CY2016 factor performance chart below which highlights ‘factors’ outweighing fundamentals – there are a number of high-quality companies that we think have become cheap. We remain alive to these opportunities, adding to existing positions in Transurban and APA in the past month.

0 Comments