Following a year of significant bond market volatility, Phil Strano has come into 2023 in a great position to generate strong defensive income from his diversified Higher Income portfolio, reflecting the higher yields available in high quality, average investment grade securities.

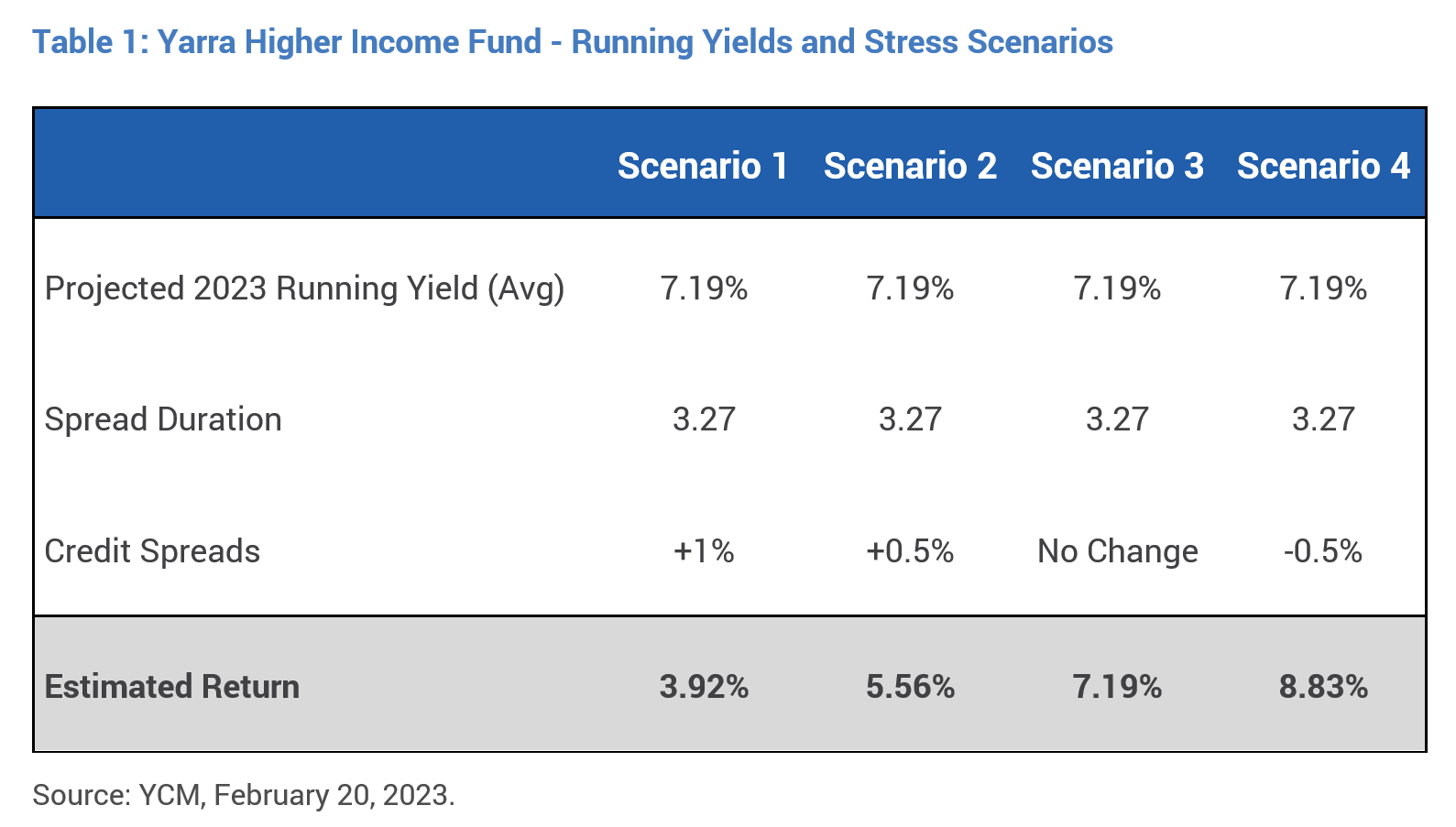

Having now locked in swap rates for all of 2023, the current running yield on the Yarra Higher Income Fund (HIF) is expected to average 7.19%, with credit spreads of ~350bps[1]. Moreover, with spread duration of only around three years, the likelihood of negative returns as a result of credit spreads widening is very low (refer Table 1).

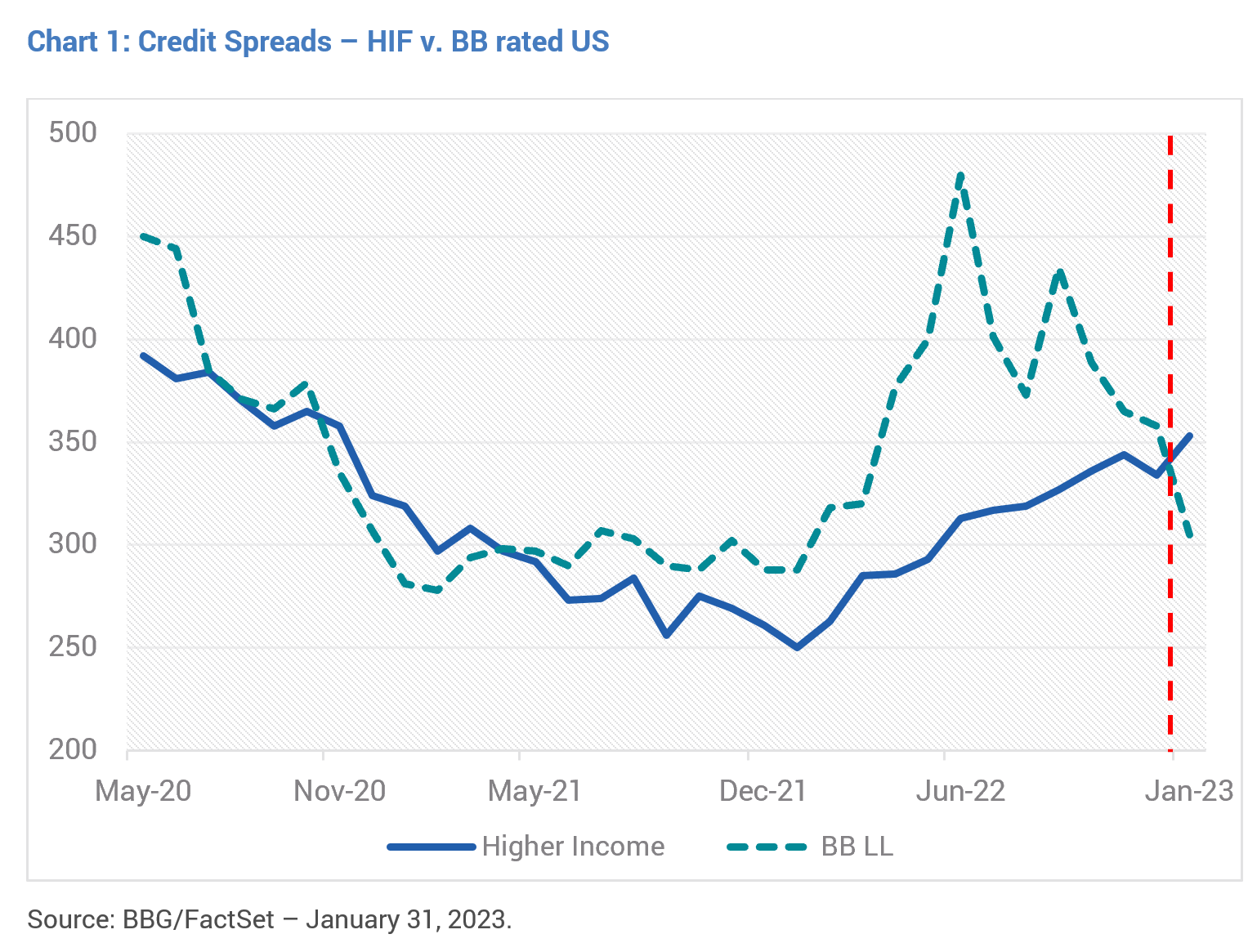

Despite being rated triple B, HIF’s yields and credit spreads compare very positively with much higher risk sub-investment grade portfolios at home and abroad. For instance, just last month, credit spreads on riskier three-year US BB-rated levered loans traded below HIF’s despite being 3 notches lower in credit quality (refer Chart 1). HIF’s yields also compare favourably to either Australian hold to maturity levered loan or other less liquid portfolios

which are generally yielding between 7.5-8.5% for sub-investment grade B+/BB- credit quality.

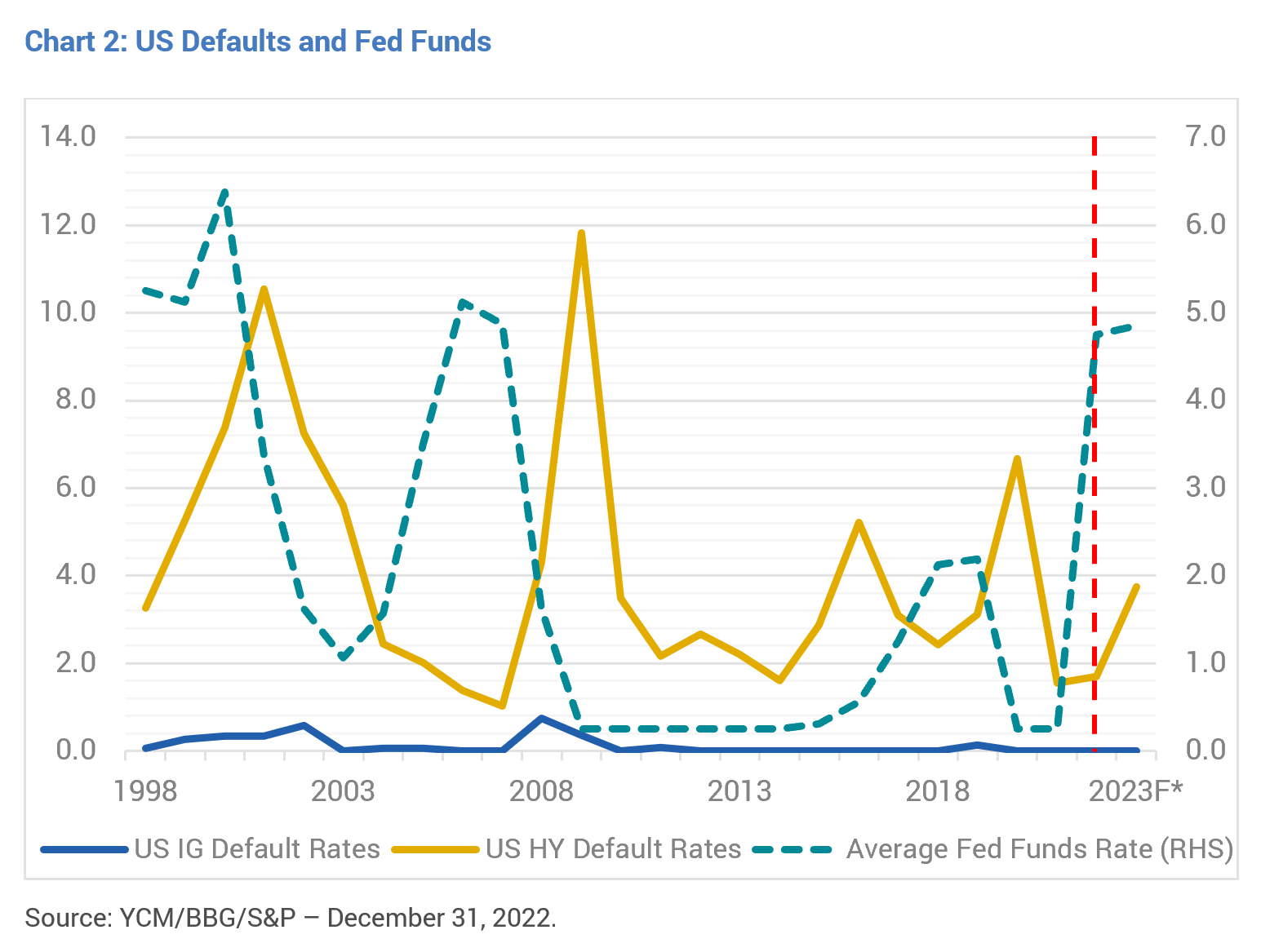

Indeed, HIF’s higher risk adjusted return profile is potentially understated when factoring in the heightened impairment risk for sub-investment grade issuers in 2023 and 2024. In the US, sub-investment grade defaults typically lag the peak in Fed Funds by ~12 months, meaning they are likely to increase materially over the next 12-18 months (refer Chart 2).

While no reliable public data is available for Australian private debt, which is predominantly rated sub-investment grade, there will inevitably be impairments as interest rates normalise after more than a decade of abundant liquidity. We are already seeing evidence that structures are becoming stretched, with a high potential for covenant breaches and impairments as the Australian economy continues to slow.

Importantly, conditions in the construction sector and the relatively large mezzanine property debt segment are likely to become more acute as we go into the second half of calendar 2023. Much higher labour and material costs, coupled with reduced borrowing capacity for property purchasers, is likely to heighten impairment risk for equity and mezzanine debt holders. Reflecting these conditions, we have no exposure to mezzanine property debt and have been very discerning in the private debt space generally, investing in very few deals we’ve analysed over the past 6 months.

This we believe emphasises our strength of combining the benefits of a large Yarra investment team across fixed income but also equities, multi asset and macro with a large opportunity set to target only the higher risk adjusted returns in Australian credit.

[1] Source: YCM, January 31, 2023.