Irrespective of how 2024 plays out for the economy and markets, fixed income will continue to play an important role in investor portfolios. With risk-free yields near 5%, fixed income is likely to contribute to returns rather than detract.

The three potential outcomes for the year ahead

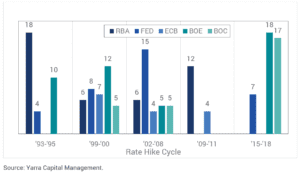

Global central banks have raised interest rates between 400-500 basis points over the past two years to combat rapid rising inflation, post-quantitative easing. With inflation coming off multi-decade highs and seemingly on track to reach central bank targets, most have paused interest rate hikes, and the market view is that global bond yields have most likely peaked. The exact timing or magnitude of any rate cut will be dependent on the economic conditions at the time, however past cycles confirm that rate cuts in 2024 are possible (refer Chart 1).

Chart 1: Months for central banks to cut interest rates after the peak in cash rate

In this note, we look at the three potential scenarios for the year ahead, assess the likelihood of each.

Table 1: Potential outcomes in 2024

Scenario one: More hikes to come

The major risk to bond markets would be if inflation and employment growth remain elevated over the first half of 2024, leading central banks to resume rate hikes under the view that they have not done enough monetary tightening. Should that occur, the magnitude of rate hikes would be significantly smaller than what we saw over the past 1-2 years.

We still attribute a low likelihood (20%) for this to occur, as we believe interest rates are high enough to curb inflation growth and slow the economy. If central banks continue to hike rates, we believe it will significantly increase the risk of a hard landing, leading to rate cuts sooner in 2024 than currently expected by markets. Domestically, the RBA also appears to be a reluctant hiker and we believe that they felt the Melbourne Cup Day hike was necessary only because of an upward revision in the central bank’s forecasts.

It is not our central case for future hikes in Australia unless the RBA’s forecasts change significantly (next updated forecasts will be released in February 2024).

Scenario two: Soft landing

The ideal scenario for all central banks would be for inflation to moderate and fall towards target, but for employment and consumer spending to remain strong. If this were to occur, we would see interest rates remaining on hold for a sustained period into late 2024. We attribute a slightly higher likelihood (30%) of this occurring, as past employment and retail sales data suggest some resilience in the economy.

Below we examine some key economic indicators in a few relevant economies and map out whether the latest data releases are strengthening or weakening, and whether the trend is accelerating or decelerating.

Table 2: Key economic indicators in relevant economies

Economic conditions overall are clearly weakening, however some resilience is still seen in Retail Sales, which could remain strong as we head into the holiday season.

Households have also benefited greatly from a prolonged period of near zero interest rates, while the build-up of savings buffers to provide protection from the rapid rise in interest rates has not been uniform. The danger to this is that monetary policy acts with a lag. Once those buffers dry up, the economy may fall into recession quicker than monetary policymakers expect. The major economies of the world are also highly interlinked; a recession starting in a major trading partner (e.g. the US or China) can send rippling effects across the global economy.

Scenario three: Hard landing

The largest risk to the global economy at present is for global central banks to have overtightened interest rates, causing inflation, employment, consumer spending and confidence – as well as economic growth – to plummet, causing a recession.

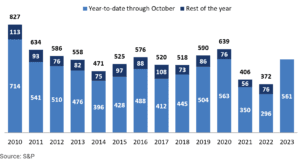

Policymakers are then more likely to cut interest rates, with the size of the cut dependent on how deep a recession the economy falls into. A moderate recession could see central banks cut interest rates by 50-100 basis points, while a hard recession could see that figure increase to 300 basis points. We attribute a high likelihood (50%) to this scenario given, historically, an overtightening of policy rates is so often a precursor to recession. The cracks in the economy are indeed starting to form, with US Bankruptcies at their highest since the pandemic in 2020 (refer Chart 2).

Chart 2: US bankruptcy filings by year

Similarly, if a recession occurs in other countries this is likely to impact bankruptcies on a global scale.

Outside of the economic outcomes, geopolitical issues remain a major risk as they make it difficult to predict how markets will react to any instability. The tensions in Ukraine still have not abated even though the initial shock to global growth and inflation has. The unrest in Gaza and Israel also has the potential to tip the Middle East back into major global conflict.

Where are the opportunities in 2024?

Bonds have traditionally provided investors with compelling yields and diversification against risky assets. The past two years have been the exception, with central banks’ interference in bond markets impacting returns. The outlook for fixed income, however, has become more positive, meaning now is an opportune time to hold active fixed rate bonds.

The most interesting aspect at present is the balance between risk-free yields and spreads. Since the Global Financial Crisis (GFC) (and even prior), high-grade markets have seen either: (1) high yields and low spreads; or, as in recent times, (2) ultra-low yields and higher spreads. It has been rare for both scenarios to contribute meaningfully to overall portfolio returns. However, with the lift in outright yields we have seen credit spreads also remain elevated, and thus both factors are now positively contributing to returns. A meaningful allocation to spread exposure will result in some high-grade securities yielding closer to 6%. This provides significant opportunities for active managers to rotate portfolios, even if rates remain at current levels for longer than expected.

Another critical opportunity for core fixed income managers is the ability to utilise interest rate duration positioning to produce capital gains for portfolios should yields fall.

How are we positioned?

Heading into 2024, we feel the risks are more skewed to steeper yield curves and lower yields as shorter maturity rates begin to price in cash rate cuts. As ever, the timing is tricky, particularly if we see higher yields in the early part of the year. If that occurs, the risk of central banks overtightening becomes more pronounced, which could see cash rates fall faster in the back half of 2024.

Spread markets may widen, particularly if we see a recession, but we primarily see idiosyncratic risks in credit markets rather than broad systemic risks (as occurred during the GFC). As such, we are holding shorter maturity credit since that is well protected against higher spreads. We also favour holding 12–15 year semi-government bonds given elevated yields, but also because of the attractive spread dynamics in that part of the curve.

Irrespective of what 2024 brings, fixed income will continue to own an important role in investor portfolios. With risk-free yields at near 5%, fixed income is likely to be a contributor to returns, rather than a detractor. Given the significant uncertainty of how 2024 will play out, remaining nimble in sector allocation will be an important driver of excess returns.

0 Comments