Dion Hershan, Head of Australian Equities, looks at why local investors might be inclined to ‘stay local’ in the year ahead.

Australian investors are known to be very parochial, and have historically reflected this attitude with a home bias – possibly because of the lure of familiarity with companies, franking credits and the currency hedge (most spend in Australian dollars).

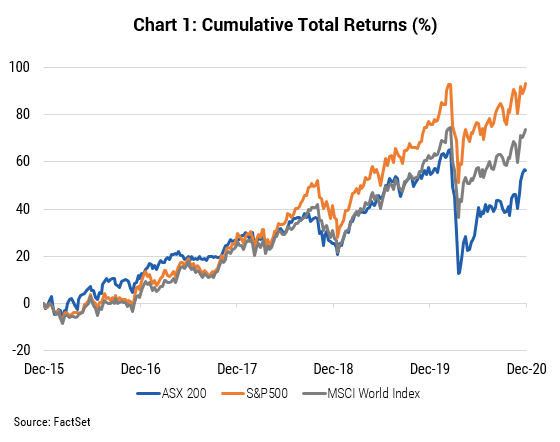

That domestic bias (with an over 50% allocation to Australian equities in our super1) has proved sub-optimal in recent years. Over the past five years the ASX has underperformed global markets by 2.4% p.a. and, in particular, the US market by 4.8% p.a.

There is, however, a compelling tactical argument for ‘staying local’ over the next few years:

- The speed and magnitude of Australia’s economic recovery is surpassing expectations, with the recent quarterly GDP print (+3.3% q/q) well ahead of consensus (+2.5%). Corporate earnings are now in an upgrade cycle (expected FY21 EPS growth has gone from 0% to 6% in the past 3 months), led by Materials, Financials and the Consumer.

- Australia has managed the COVID health crisis well versus other developed nations. While the US is contending with >150,000 cases a day and most of Europe has been in lockdown to keep COVID manageable, Australia has effectively eradicated local transmission, and as such business and consumer confidence is rapidly rebounding (consumer confidence surged 4.1% to 112 this week – its highest level since December 2010).

- Consumers have been surprisingly resilient and are now in a healthy position. We expect a strong Christmas trading period in the context of a high savings rate (at 18.9%), rising asset prices (national house prices +0.8% in November) and strong consumer sentiment (+2.6%m/m in November).

- Fiscal and monetary support. Though JobKeeper ends in March next year, this is offset by a raft of federal and state government initiatives including JobMaker, property and income tax relief, instant asset write-offs, temporary loss carry-back measures, accelerated depreciation deductions and housing/infrastructure spending. Meanwhile, record low interest rates and a formal QE program should support asset prices.

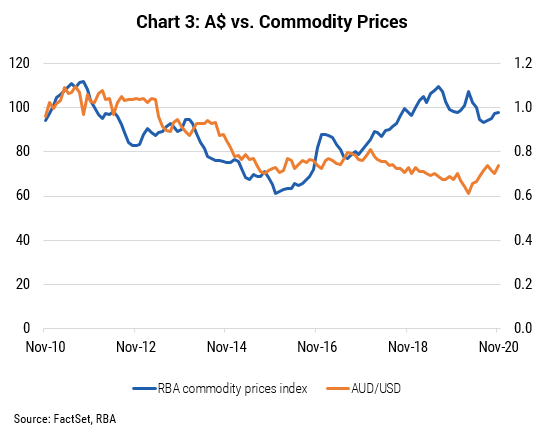

- The AUD could strengthen further, creating even more of a headwind for offshore earners. The currency has lifted from US70c to US74c in the past month, well above the average of US67c in FY20, on higher commodity prices and “risk-on” sentiment.

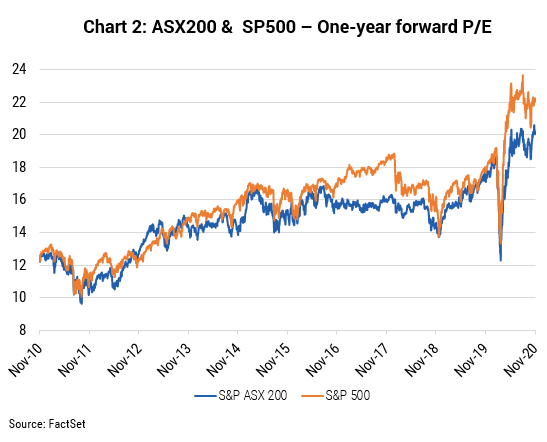

- Relative value vs. global markets. While the ASX may appear expensive on an absolute basis (at 20.2x forward earnings), it is trading at a 9.3% discount to the S&P500’s 22.2x earnings – well below its 10-year average of 5.5%.

What is debatable, though, is how the sector composition of the Australian market will fare versus global equivalents. Its heavy reliance on banks (20%), REITs (7%) and resources (20%) means it has more ‘value characteristics’, particularly versus the S&P500 and its 28% weighting to Tech . I won’t dare wager into the ‘growth vs. value’ debate, but is an obvious point the Australian market is far more leveraged to ‘value’ and as such offers lower P/E multiples and higher yields.

We have positioned our portfolio accordingly, only owning a select few global businesses which we feel have exceptional prospects (e.g. Aristocrat Leisure, James Hardie). Instead we are significantly skewed towards the local economy – being overweight banks which will be a winner as bad debt levels recede – and domestic cyclical businesses including Reece, JB Hi Fi, Nine Entertainment and Bluescope.