COVID-19 and the ensuing economic damage has called into question the safety of Australia’s REITs and their safe haven status. In this note, Phil Strano, Portfolio Manager of the Yarra Absolute Credit Strategy, provides his thoughts on the outlook for the sector.

The investment grade (IG) REIT sector is certainly one of the worst affected by the COVID-19 pandemic. Across the June quarter, only 77% of revenues (rent etc.) were collected, with the retail sector collecting just 58% of contracted revenues. Net tangible asset values (NTAs) across the market declined 5.2%, driven lower predominantly by devaluations in retail property.

Further devaluations in retail and office property are now widely expected, as structural implications of the pandemic begin to emerge. Specifically:

- The work-from-home phenomena is changing how and where we work: the future shape of the workforce will inevitably offer more flexibility for employees; and

- The surge in online retail is changing how we shop, with the changing sales mix (in-store falling, online rising) challenging the relevance of many physical retailers.

As credit investors, having a clear understanding of the implications of these dynamics, and how they will impact debt investor protections such as covenants and serviceability is fundamental to the delivery of strong risk-adjusted returns. Indeed, it has probably never been more important.

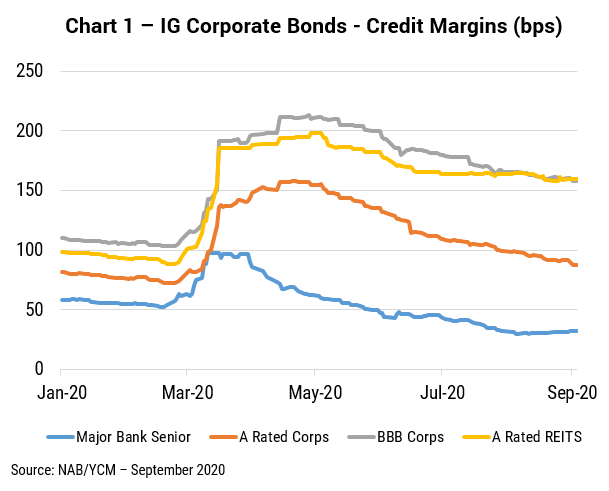

Unsurprisingly, these structural changes are impacting creditworthiness, with REITs now compelled to pay more on new debt than non-REIT issuers. REIT credit margins, which represent the major portion of interest payable to investors on new and existing bonds, now trade closer to riskier corporates (Chart 1) and lag similar rated corporates and the major banks.

There’s little doubt the pandemic has driven an increase in risk across much of the IG REIT sector. The key question facing credit investors today is whether they are being appropriately compensated and protected from impairments.

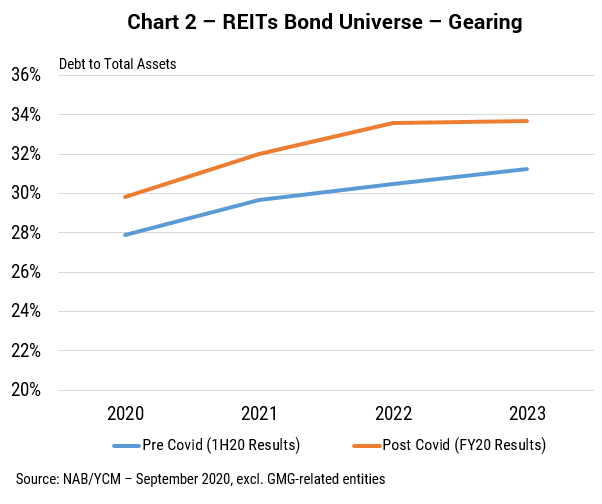

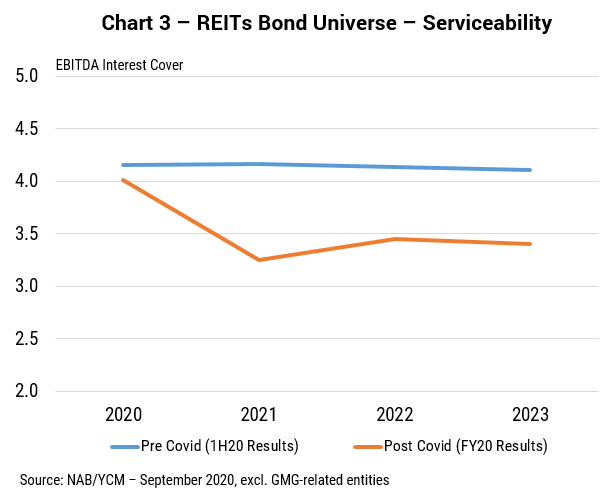

Based on our credit data and forecasts out to 2023, we do see a clear path to sustainability and value. While we do expect lower earnings and falling valuations will increase gearing (debt to total assets) and reduce debt serviceability (EBITDA interest cover) (Charts 2 and 3), gearing remains relatively low even at these higher levels. Creditors are well-protected from future impairments.

A-rated REITs Scentre and Vicinity, two retail property groups most impacted by COVID-19, are two companies where credit investors appear better placed than equity holders. Both companies entered the pandemic with strong balance sheets offering very high protections for credit investors. So while falling earnings and lower valuations are impacting shareholder dividends, gearing levels of 30-40% leave credit investors largely quarantined from the pandemic, with coupons and principals secured.

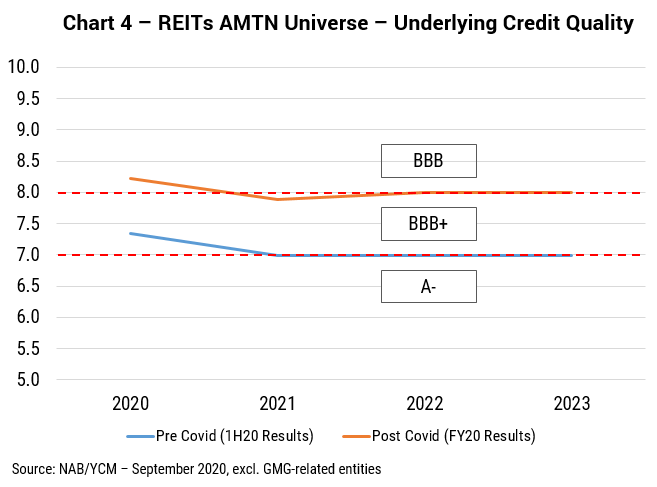

Our proprietary credit models do project an uptick in risk and potential credit rating downgrades across REIT issuers (refer Chart 4). This is largely captured in current valuations, however, and also discounts any management action to raise new equity and de-lever balance sheets.

With income returns of between 3.5-4.5%, the current pricing for maligned REIT issuers offers compelling value in this exceptionally low yield environment. With worst-case scenarios appropriately priced in, and with a very low risk to the payment of future coupons and principal, we are selectively adding REIT exposure to our dedicated Australian Credit portfolios at very attractive levels.