Investors in sub investment grade (sub-IG) private debt are facing the prospect of their first meaningful default cycle later this year and into 2024. In fact, the lure of comparatively higher yields in the post-GFC (i.e. low rate) environment, along with the promise of no volatility appears to be unravelling. Phil Strano, Senior Portfolio Manager, explains why he’s focused more than ever on owning quality.

We were reminded of our wariness by a recent Financial Times interview with Howard Marks, co-founder of $172b investment group Oaktree Capital, who warned of a private credit crunch in the US on the back of higher interest rates and slower economic growth, which is severely impacting the credit quality of corporate America. This also feels particularly relevant as the US debt ceiling deadline draws near.

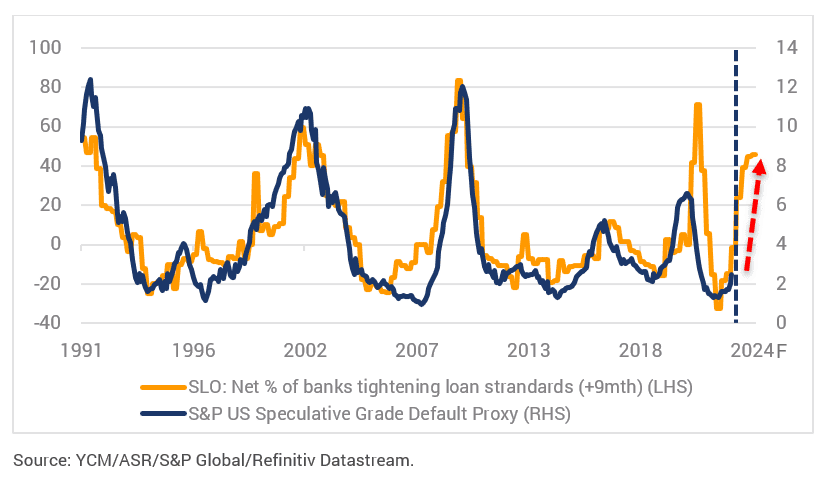

While traded US high yield bonds have similar underlying credit risk profiles to private debt, they are at least mark-to-market and tradeable. In these aspects they are unlike most private debt, where the prevalence of zero volatility portfolios with limited liquidity masks escalating impairment risk as economic conditions deteriorate. The latest US Senior Loan Officers (SLO) Survey, which measures the percentage of US banks tightening lending standards, suggests a meaningful increase in US high yield defaults is coming (refer Chart 1)

Chart 1: US SLO Survey Points to Higher Speculative Grade Default Rates

In their latest analysis of the US high yield market, S&P has a base case for defaults picking up from 2.5% in March 2023 to 4.25% in 2024. We expect this will be proven to be an optimistic forecast – the red arrow in Chart 1 shows the likely trend – given this cycle is characterised by much higher interest rates compared to any other post GFC cycle. We also expect the more opaque private debt market will be similarly impacted, with the added complication of many conflicted asset managers using questionable valuations.

We expect a similar thematic in Australia, albeit that it will play out in sub-IG private debt since we do not have a developed local high yield (HY) market. Rising impairments across Australian private debt are foreseeable in a range of pockets, including mezzanine property development lending and levered loans exposed to discretionary cash flows.

From our perspective, both the Yarra Enhanced Income Fund (EIF) and the Yarra Higher Income Fund (HIF), with their average investment grade (BBB rated) portfolios, aim to provide a much higher quality exposure than higher yielding private debt/levered loan portfolios (typically BB-/B+).

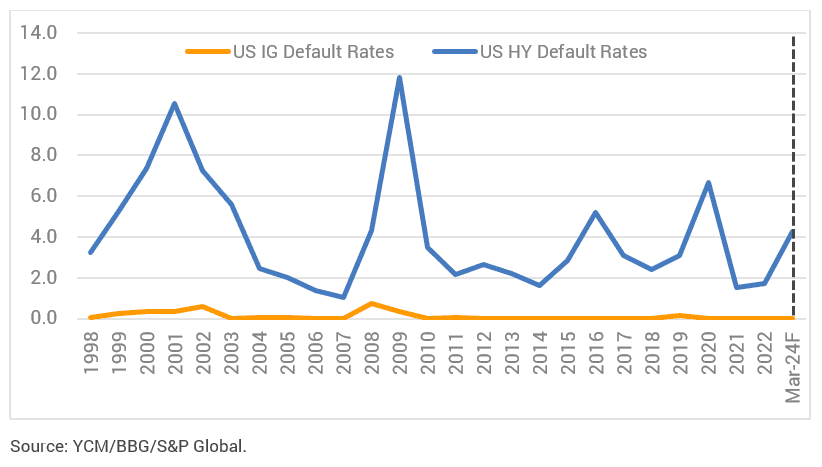

The impairment risk for both EIF (which does not invest in private debt) and HIF (which only selectively invests in syndicated loans and currently holds no private debt) is more akin to IG which is virtually non-existent compared to HY (refer Chart 2). Moreover, despite being much higher quality, EIF (+287bps) and HIF’s (+363bps) credit spreads in mid-May, compare very favourably to sub-IG loan benchmarks such as JP Morgan’s US BB rated Levered Loan Index (+353bps).

Chart 2: US Investment Grade Default Rates Virtually Non-Existent vs. High Yield

Yarra’s much higher quality EIF and HIF portfolios, combined with ~6.5-7.0% yields, seek to provide an attractive alternative to private debt, offering defensive income from highly liquid investment grade portfolios, with lower impairment risk and transparent pricing.

0 Comments