In the spirit of getting a better understanding of disruptive technologies, we recently attended a Bitcoin and Blockchain conference in New York. The conference started with a show of hands, where it became apparent we were not in the 90% of people who owned Bitcoins.

Every instinct suggests Bitcoin has the signs of a classic bubble/pyramid scheme: a self-created currency, where the authorisers earn commissions for auditing transactions, all wrapped together through a neat (and sustainable) technology referred to as Blockchain. The hype, hysteria and momentum has seemingly become self-fulfilling. There is no hard asset backing behind the currency, it is however limited to 21 million units (currently at 12 million). It is highly debatable if Bitcoin fits the classic definition of a currency.

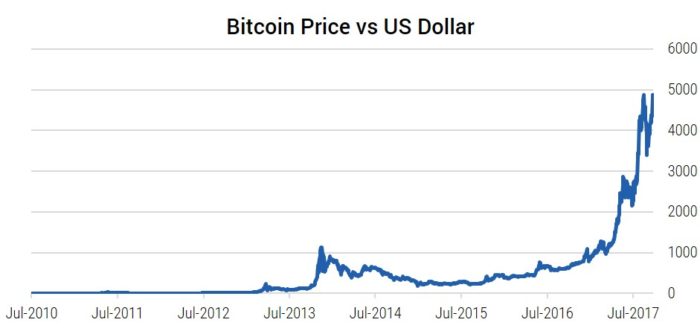

- Having a store of value – Bitcoin has 90% annualised volatility and is up 20x in the past 3 years (see below chart);

- Being a medium of exchange – only a small number of retailers accept it; and

- Being a unit of account – Bitcoin doesn’t exhibit any signs of having a stable value.

It’s impossible to know what a Bitcoin (tulip) is genuinely ‘worth’ and we’re not sure we would have the courage to short it (is up 4x YTD), but what is clear is it’s completely unregulated and is becoming systemically important. In total about $1 trillion of Bitcoins have traded, the value in circulation is $80 billion (rival cryptocurrencies have equivalent value), trading $1 billion per day. ‘If’ Bitcoin were to collapse, it would be highly likely to have broad financial implications and could signal the start of the unwind in a lot of the speculative activity which is thriving in what increasingly appears to be complacent financial markets.

In our view we should add the speculative frenzy around cryptocurrencies to the list of risks facing the financial system, though sadly it’s probably not in the top 10.

For anyone with an opposing view, the good news is there are now a full 20 Bitcoin ATMs in Australia.

Some great quotes (unattributed) from a few conference speakers:

- “The biggest risk is not investing in cryptocurrencies”

- “There is a lack of leverage in the system, it limits liquidity”

- “It’s exciting, Bitcoin options, swaps and futures are coming soon”

- “It’s easy to be long this market, it’s difficult to get short in any size”

- “Bitcoin can do strange things like disappear If you are not careful”

- “Bitcoin is not turning out to be a good unit of exchange but that’s still ok”

- “I originally thought it was unicorn monopoly money but I changed my mind”

- “This asset class can go to a trillion dollars of value based (from $150 billion) on the ‘speculation’ use-case”

0 Comments