Hybrid securities can offer investors equity-like returns, yet with a lower level of risk. In this piece developed in conjunction with Money Management, Co-Head of Fixed Income Roy Keenan provides a rundown on hybrids and explains why they are attractive investment options.

What can deliver returns like an equity but behave like a bond?

Answer: A hybrid.

According to Roy Keenan, co-head of Australian fixed income at Yarra Capital Management, this is one of the reasons this asset class continues to grow in popularity.

However, it’s still an emerging area for many investors. This means key aspects of hybrids are often misunderstood, such as where they sit in the capital structure, the different types of hybrids available, and their role in an investor’s portfolio.

What is a hybrid?

Hybrids are securities with a blend of equity and debt. Some behave more like equities, and some like debt, and can broadly be grouped into three categories, each having different characteristics.

First, convertible debt securities give the investor or issuer the option to convert their principal plus accrued interest into an equity investment – usually ordinary shares – at a future date. Second, preference shares provide regular income payments, but unlike ordinary shares, the income is paid as dividends at a rate that can either be fixed or floating.

Like a bond, they can be converted to cash at maturity. Finally, capital notes, which include perpetual debt, subordinated debt, and knockout securities, pay regular interest until the note is redeemed, at which time the principal is repaid to the investor.

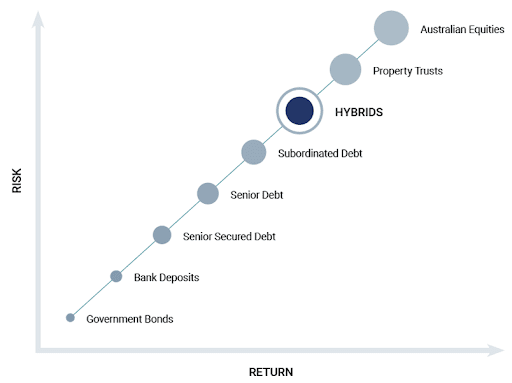

Importantly, hybrids sit higher in the capital structure than equities, meaning in the event of a default, hybrid holders will get paid before equity holders, so are not as risky. However, they sit below senior debt, which has no conversion to equity – hence higher returns.

Yarra Capital Management sees this place in the capital structure as a strong source of returns.

“A hybrid security is predominantly debt, so you’re getting an equity-like return for debt-like risk,” Keenan says.

Chart 1: Risk v return

Source: Yarra Capital Management

Hybrid issuers

Many types of organisations issue hybrids. For example, banks or insurance companies often do so to meet APRA capital requirements.

“Hybrids are beneficial for their balance sheets, as a portion of the allocation counts towards equity. However, it’s more cost-effective than issuing equity, and doesn’t dilute existing shareholders,” explains Keenan.

However, corporates also issue hybrids, usually when they need to strengthen their balance sheets by raising capital. For example, hybrids can be a great way for a REIT to counter falling property prices, helping to preserve its credit rating and keeping debt levels down.

“They might be in a position where they don’t want to sell any assets cheaply, and they don’t want to dilute shareholders through issuing equity, so a hybrid is often a great option,” Keenan says.

What are the risks?

When it comes to hybrids, risk is important to understand, especially for those hybrids issued by banks and insurance companies which tend to be the ones retail investors most commonly invest in.

“You’re ultimately looking at a credit decision to ask, ‘Is this bank going to be able to meet its obligations’?” Keenan says.

“And as you move further down the capital structure, we’re still talking about the issuer being a quality organisation.”

He adds that the returns are pretty good compensation, with hybrids typically picking up two or as much as three times the credit spread of senior debt. And, Keenan says, it’s worth noting that conversion to equity is not necessarily a downside for hybrid holders as there are protections.

“There are rules and formulas in the offer documents that tell you how many shares you get through any hybrid conversion,” Keenan explains.

Upon conversion, an investor will receive $100 of equity for $100 of hybrids until the maximum conversion is reached.

“One of the key issues to understand is a company’s ability to right the ship if something does go wrong. And there’s no doubt that the Australian banks and insurance companies are best placed for this,” Keenan says.

Understanding returns

Hybrids provide investors with regular interest payments, often at rates higher than those offered by traditional bank term deposits or conventional corporate bonds. This enhanced yield potential can serve as a valuable income stream for investors seeking higher returns.

Most hybrids are floating rates – one of the few securities that are. As interest rates rise, so do the returns.

“That risk-adjusted return versus equity is a no-brainer,” Keenan says.

Generally, the higher the running yield of an investment, the greater the protection it offers investors from adverse movements in credit margins. If credit margins deteriorate, causing the investment’s credit rating to decline, investments with higher running yields may still provide sufficient income to offset some losses incurred due to lower credit quality. For example, the running yield for the Yarra Enhanced Income Fund Keenan manages is currently sitting at 6.47 per cent.

Getting exposure to hybrids

Investors can access a small selection of hybrids on an exchange, but not the universe of securities predominantly available through the secondary markets.

The hybrid market can experience low levels of liquidity compared to equities listed on the share market. This means that investing directly via an exchange can be more costly for retail investors because the bid-offer spread (the difference between the market price that hybrids are bought and sold for) can vary enormously on any given day.

For an active fund manager, buying power means they can access liquidity in the professional market or trade in the over-the-counter (OTC) market, which experiences greater volumes than a retail investor can access on the ASX. They can also trade directly with other financial institutions that offer better terms and a tighter bid-offer spread.

Investing through a fund can be a good idea, as it is easier for a fund manager to move up and down the capital structure for value, Keenan says. Also, some OTC hybrid issues have minimum participation levels of half a million, meaning they’re more suitable for wholesale investors.

Like any investment, it pays to do your research before you invest. But hybrid securities are complex, and each has its own terms and conditions, some of which can run to hundreds of pages. It doesn’t take an expert to work out that it takes an expert to understand the risks and merits of hybrid security! That’s where an actively managed fund can help, as they have the time and expertise to evaluate the risk/return characteristics associated with individual hybrid securities.

One of the most important reasons for investing in hybrids through an actively managed fund is to capture market-beating returns. The complex nature of hybrid investments means they can often be mispriced. This presents an opportunity for a skilled investment manager to take advantage of the relatively inefficient market and profit from higher risk-adjusted returns. Investing through a professionally managed fund can also take advantage of the diversification and risk management benefits.

0 Comments