In a world where macro news is nothing short of chaotic and confusing, it’s worth focusing on the micro for a change. In his latest Insight piece, Dion Hershan, Portfolio Manager of the Yarra Ex-20 Australian Equities Fund, explains why the notion of the ‘permanent blue chip’ appears seriously challenged.

The resilience of both the Australian economy and the share market has been well documented, but it masks massive divergence and slow-moving trends that can be profound over time. Just like a leaky bucket, some ‘stalwarts’ of the market have faded: Boral, CSR, Tabcorp, and News Corp are now all ‘Small Caps’ and AMP could well be (currently ranked #110 by market cap). In reviewing large cap companies, we now actively ask: ‘is this future small cap’?

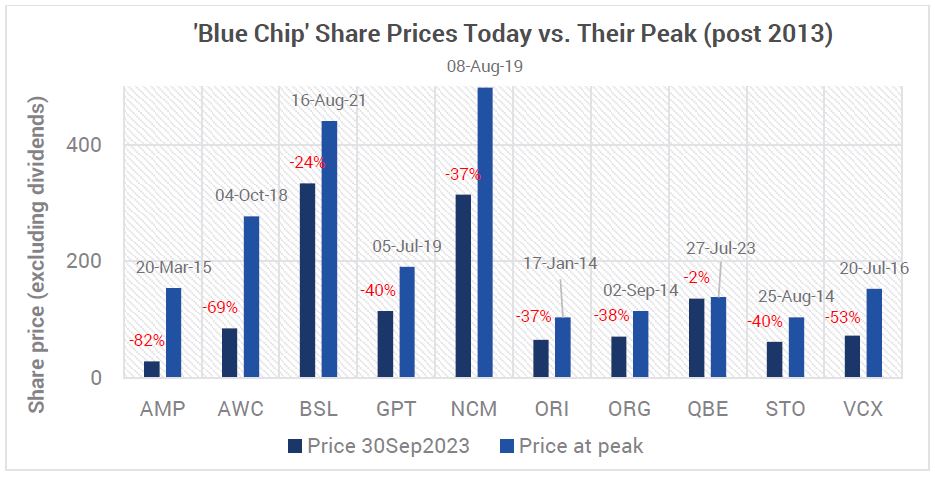

We seriously challenge the notion of ‘permanent blue chips’ in the Australian market, noting that industry structures, regulation and business/consumer preferences change too quickly and too often. While the Australian share market has had overall capital appreciation (ex dividends) of 31.7% since 20131, companies previously identified as blue chips including AMP, Vicinity, Alumina, Bluescope, GPT, Santos, Orica, QBE, Origin Energy and Newcrest all have lower share prices over that same time period (refer Chart 1). There has literally been a lost decade!

Chart 1: ‘Blue Chip’ performance (last 10 years)

Source: Bloomberg. From 1 Jan 2014 to 30 Sept 2023.

The concentration of the ASX 200, anchored by companies that could well be past their peak, is a real issue for investors to deal with looking forward. By way of example:

- The diversified mining sector (BHP, Rio Tinto, Fortescue Metals) represents ~14% of the market and is actually not that ‘diversified’ (iron ore is currently 60%+ of earnings). We believe the commodity is on borrowed time: high prices and margins could prove fleeting since China’s steel consumption has seemingly peaked, major new supply is coming to market from African producers within five years and, longer term, scrap steel is becoming an environmentally friendlier alternative

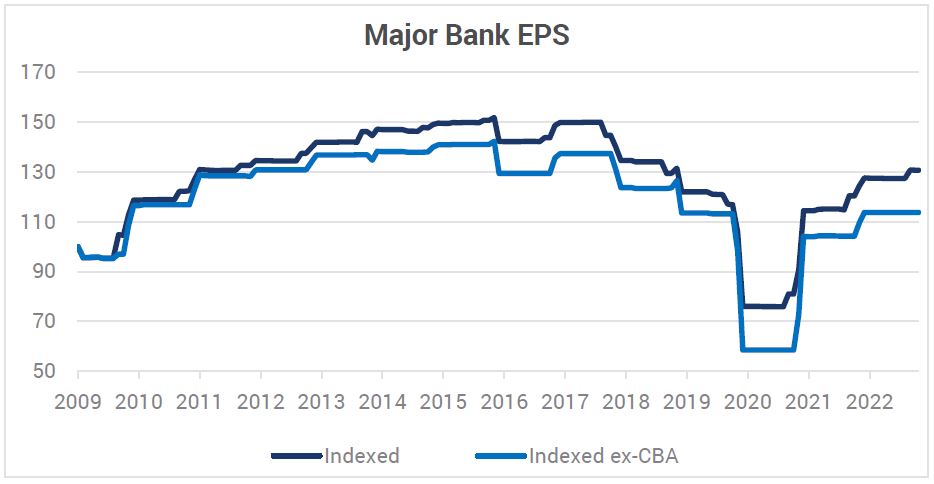

- Australia’s Big 4 banks (20% of the ASX 200) face major structural (not just cyclical) headwinds from market maturity, competition, cost growth and ROEs (in decline for a decade). The sector’s earnings peaked in the second half of FY16 (pre-Financial Services Royal Commission) (refer Chart 2) and three of the Big 4 have substantially lower share prices today than a decade ago

Chart 2: Australian Major Bank Earnings in Decline

Source: YCM, Bloomberg. Oct 2023.

Against this backdrop, it is our view that investor complacency is a risk, meaning conventions have to be challenged. Clearly, the notion of ‘buying and holding’ carries meaningful risks.

We are more focused on finding the next generation of quality companies which are miles away from their peaks and capable of generating strong capital appreciation. We remain appropriately paranoid to ensure they remain on track rather than ‘growing’ into future fallen angels or value traps. With the interest rate on a term deposit now exceeding the yield on the market (for the first time in 12 years), dividends alone are clearly not sufficient.

Recent changes to our portfolios include increasing positions in ResMed (due to an extreme over reaction to the risk around new weight loss medications) and Tabcorp (a solid franchise in the midst of favourable structural changes), and initiating a position in APA (recognising the important role of gas in the medium term and the company’s shift to renewables).

0 Comments