Ed Waller, Deputy Portfolio Manager of Yarra’s Ex-20 Australian Equities Strategy, details why he’s optimistic on the outlook for the listed Australian insurance sector.

Insurance is complex, technical, mundane and outside of the actuarial community is thought to be incredibly boring… There are no SAAS multiples, no exposure to new energy or rapid growth stories. That aside, we believe there is a time, a price and a place for almost everything. And for the first time in close to a decade we believe insurance is now compelling.

If we had to distil this thinking into eight simple reasons it would be as follows:

- The sector is one amongst a handful that benefits from higher interest rates, with a 1% increase in rates equating to 10-20% earnings upside

- It has potentially the best industry structure, operating as a functional oligopoly; the two major domestic insurers have a 68% market share and have successfully prioritised pricing

- Insurers are causes of inflation rather than suffering from it; Home and Car Insurance premiums are rising 5%+ p.a., and commercial insurance at 10%+ p.a.

- After a surge in natural hazards, it ‘probably can’t get much worse’; the July to October 2021 period saw natural hazard costs at 8-times normal levels

- Unlike other sectors, we expect there will be no post-COVID earnings slump; insurers have experienced three years of trough earnings, with FY22 earnings estimates for IAG and Suncorp ~20-30% below FY19

- The sector raised billions in business interruption reserves, much of which of which we expect is surplus to requirements and will be returned to investors

- In an overheated market (yes still!), insurers remain attractively valued and trade in line with long run historic multiples

- The sentiment towards the sector and expectations probably couldn’t be worse (3-year average underperformance of 30%), meaning not a lot has to go right!

These factors confirm for us that the insurance sector now looks compelling, which is now one of the Yarra Australian Equities Fund’s largest sector overweights via exposures in QBE and IAG.

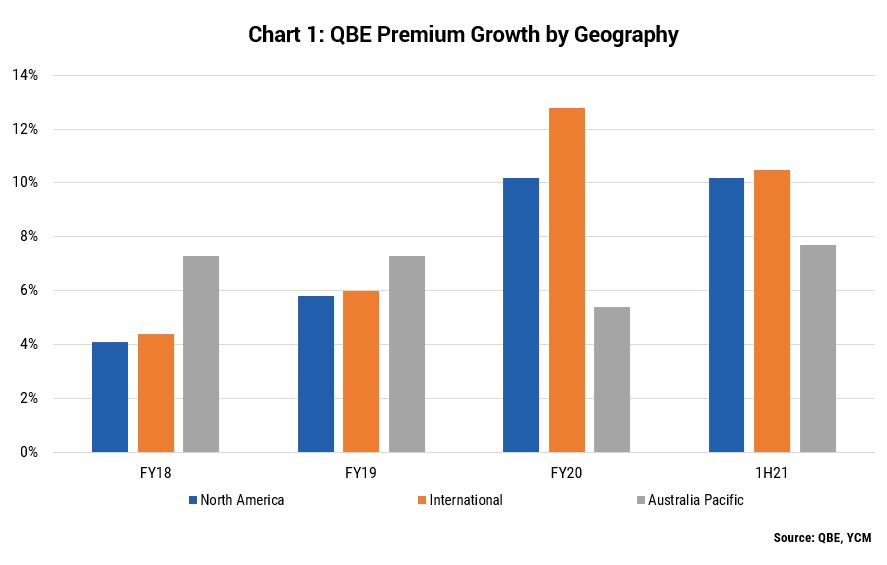

QBE is seeing strong topline growth through both double-digit rate increases (Refer Chart 1) and policyholder growth and has the most interest rate leverage.

IAG, meanwhile, has been de-rated after experiencing 8-times normal losses in the first 4 months of FY22 (refer Chart 2) – which we view as a genuine one off – and its $1.15bn in largely unnecessary business interruption provisions speaks to capital flexibility.

Both QBE and IAG represent examples of companies trading in line with their long run average valuation multiples, which are an exception in the current market where 75% of Industrials are trading above long run average multiples.

0 Comments