We have been cautious on Residential Mortgage-Backed Securities (RMBS) for some time due to weakening fundamentals, including tightening spreads and falling property prices. Recently, though, there have been some tentative signs of value re-emerging, with a select number of opportunities coming to market offering great value.

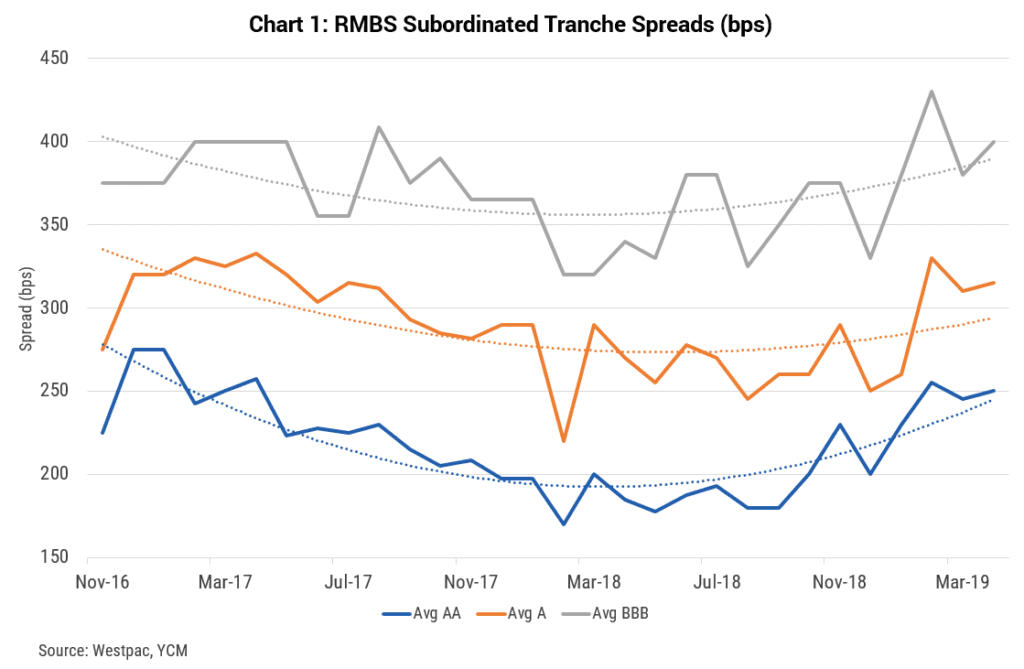

So what’s changed? Following a plethora of issuance, spreads have recently widened back toward more historic levels (refer Chart 1). In some cases, we believe credit support is now actually overcompensating for current and expected house price declines.

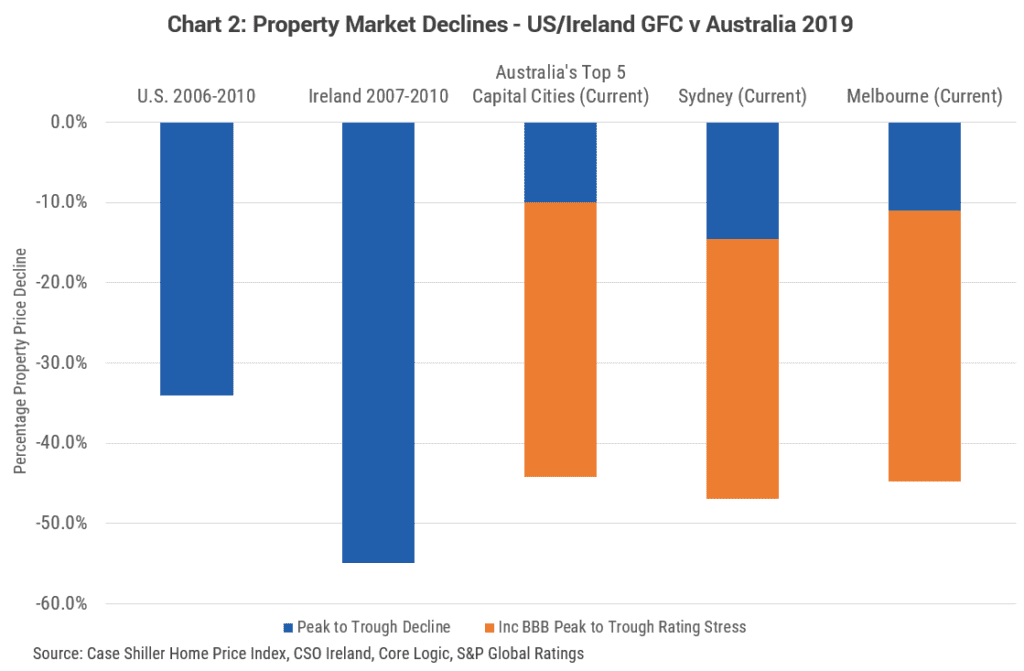

One recent example is non-bank lender Mortgage House. Its Series 2019-1 Class D notes are backed by a pool of prime, full-documentation borrowers, and with relatively benign tail risk. The notes are rated BBB by rating agencies which reflects credit support sufficient to absorb an extreme scenario of a further 38% property price decline. This is despite Sydney and Melbourne property values having already declined by 15% and 10% respectively, meaning that in calculating credit support this stress assumption actually equates to a total peak to trough price decline of around 45%.

Such a decline, in our view, is extremely unlikely. Falls of this magnitude are higher than those used to calculate credit support at the top of the housing cycle for AAA rated notes, and more than 10% higher than the peak to trough stress experienced by the U.S. during the GFC (refer Chart 2).

On a relative value basis, RMBS now looks increasingly attractive. The margin of safety has improved and RMBS spreads have widened since the beginning of 2019 at the same time they’ve tightened across AUD corporate credit. Adding to this is the increasingly supportive backdrop, with interest rates low and expected to remain so, and a recent loosening of macroprudential rules.

With an internal credit modeled rating closer to A than BBB and issued at BBSW+380bps, the Mortgage House Class D notes offer fantastic value in a market which up until recently has lacked such opportunities.

0 Comments