With warming very likely to exceed 2°C, investors face a radically altered investment landscape marked by intensifying physical risks, rising litigation and liability, evolving regulation and uneven progress in transition readiness. This paper outlines how we are recalibrating our research agenda and investment process in response to these profound structural changes. Our base case outcome driving our research approach now focuses on an adaptation and mitigation response rather than achieving a net zero outcome. To be clear, we believe we must continue to pursue net zero objectives. However, as fiduciaries, we must take a pragmatic approach to managing climate risks and opportunities.

The New Climate Reality

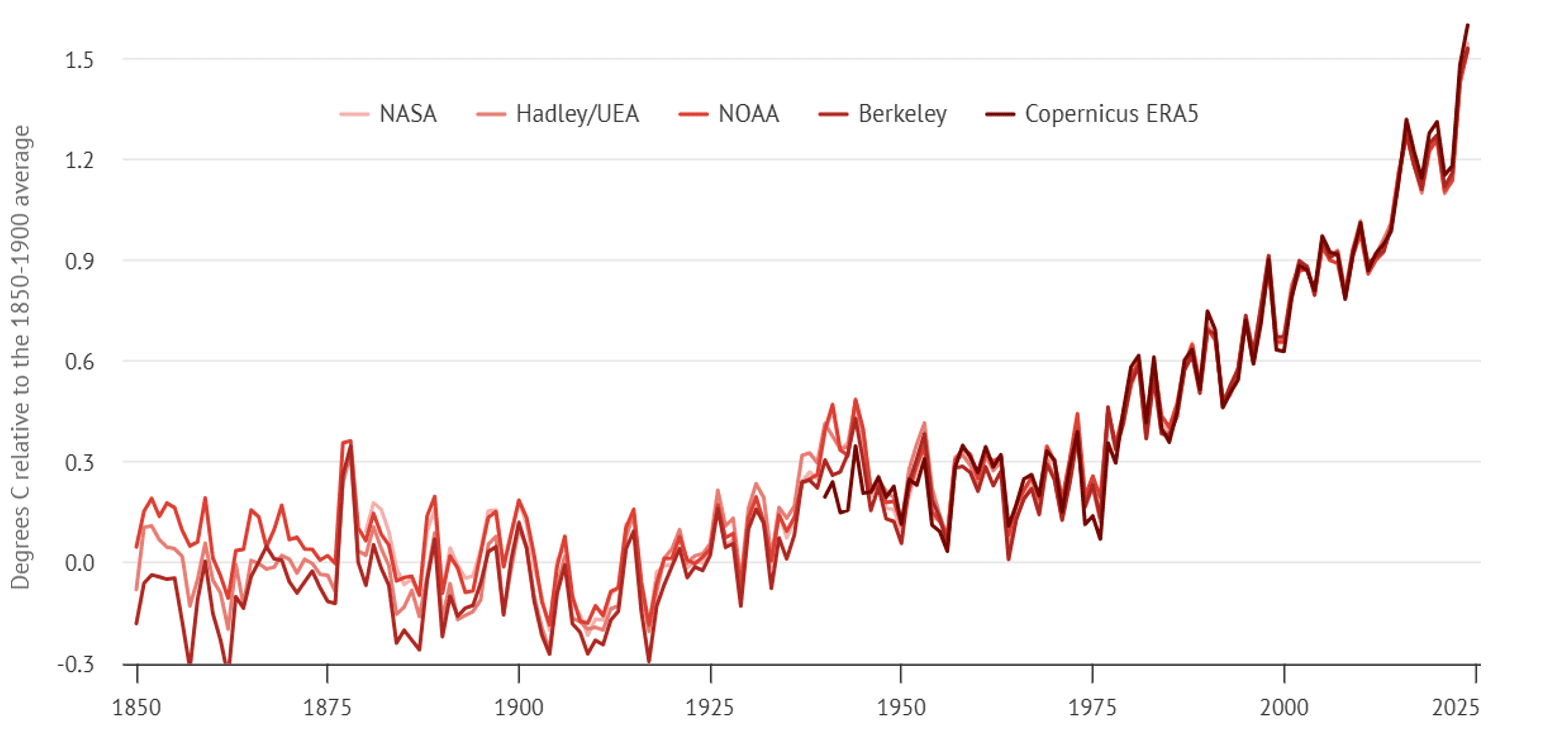

The world has already surpassed 1.5°C of warming[1] (refer Figure 1), and current policy pathways suggest temperatures will surpass 2.4°C this century. Many physical climate events—heatwaves, wildfires, droughts and floods—are accelerating in frequency and severity[2]. The investible universe in Australia and globally is materially exposed to both direct and indirect consequences of this warming trajectory.

Figure 1. Global surface temperatures over time relative to pre-industrial baseline

Source: Carbon Brief, Jan 2025.

The Intergovernmental Panel on Climate Change (IPCC) 2023 AR6[3] report projects that our current policies and technological trend is pointing to well over 3°C warming by the end of the century, noting that we have already exceeded two-thirds of the global carbon budget to stay below 2°C. Indeed, the current Nationally Determined Contributions (NDCs) under the Paris Agreement[4] are insufficient to limit the world’s warming to below 2°C and are now projected to lead to warming above 2.4°C. And in Australia, the growing recognition of this climate reality has led to the appointment of a new position, Special Envoy for Climate Change Adaption and Resilience following the May 2025 federal election,[5] and the recent release of the Australian Adaptation Database[6].

Investment Risks are on the Rise

Physical risks are already driving financial losses. For example, Californian utility company Pacific Gas and Electric (PG&E) was forced to file for Chapter 11 bankruptcy in 2019, flagging over US$30 billion in liabilities after being held responsible for equipment failures and downed power lines that started the 2017/18 Californian wildfires, including one blaze which caused 84 fatalities. PG&E’s share price is yet to recover and trades today some 3-4 times below its pre-wildfire levels (refer Figure 2).

Figure 2. PG&E’s share price fell 91% between Sept 2017 and Jan 2019

Source: YCM, Bloomberg, May 2025.

Beyond being impacted by physical events, companies are also increasingly likely to be held liable for their contributions to physical events. Climate litigation is expanding. A recent model[7] attributes over US$8.5 trillion in damages globally to top fossil fuel producers. This research extended to Australia’s five largest fossil fuel producers over this same period, with an estimated US$682 billion in economic damages directly attributable to these companies.

Shareholders, clearly, will be impacted by rising corporate accountability for climate change. Attribution of cost implications of physical events to specific companies will be important to watch. In Table 1 (refer Appendix), we summarise the impacts on companies from physical disruptions as well as the potential liabilities associated with causing physical events. A detailed list of sector-specific considerations is also included in Table 2 (refer Appendix). We are actively analysing these risks to every company that we research, and it now forms a key pillar in our engagement agenda.

Portfolio Implications for a Warming World

As investors, understanding (i) the portfolio implications of a likely delayed transition; and (ii) the higher physical impacts resulting from climate change are critical.

Our process is also evolving. Whereas like many investors we have historically worked to understand the path to targets and the associated risks, our focus has shifted to focus acutely on mitigation and adaptation.

We are moving beyond ‘net zero pathways’ to model how climate outcomes – not just targets – affect value and risk. Our analysis now focuses on physical exposure mapping, litigation trends and adaptive capacity across sectors.

Key opportunities include companies enabling climate adaptation, resilient infrastructure, diversified and adaptive supply chains, and carbon removal technologies. We expect to observe:

1. Climate Adaptation

-

- Higher end market pricing: companies will adapt and manage input cost pressures and use pricing power in response to climate disruptions.

- Rising building, construction and consumer staples demand: some companies will benefit from a world where increased property damage and emergency stockpiling is more common.

- More product diversification: there is ample evidence globally of investment in product diversification as a climate-risk management strategy. one of the world’s largest meat producers – the US-based Tyson Foods – is investing in insect and plant-based protein production, in part driven by their identification of climate-related risks. Australian companies can be expected to adopt similar strategies.

2. More Resilient Infrastructure

-

- Increased infrastructure investment: we expect an increase in companies investing in resilient infrastructure, benefitting suppliers of these materials. We expect tailwinds for engineering firms and REITs and suppliers focused on flood prevention, drainage, water efficiency, infrastructure hardening and wildfire prevention.

3. Increasingly Diversified and Adaptive Supply Chains

-

- Greater supply chain investment: understanding critical materials supply chain bottlenecks and contingencies for supply chain disruptions will present opportunities for diversification and innovation, notably in logistics as well as product innovation.

4. Greater Investment in Carbon Removal Technologies

-

- Heightened investment in carbon sinks: we expect rising land use approaches as well as greater investment in carbon technology, capture and storage.

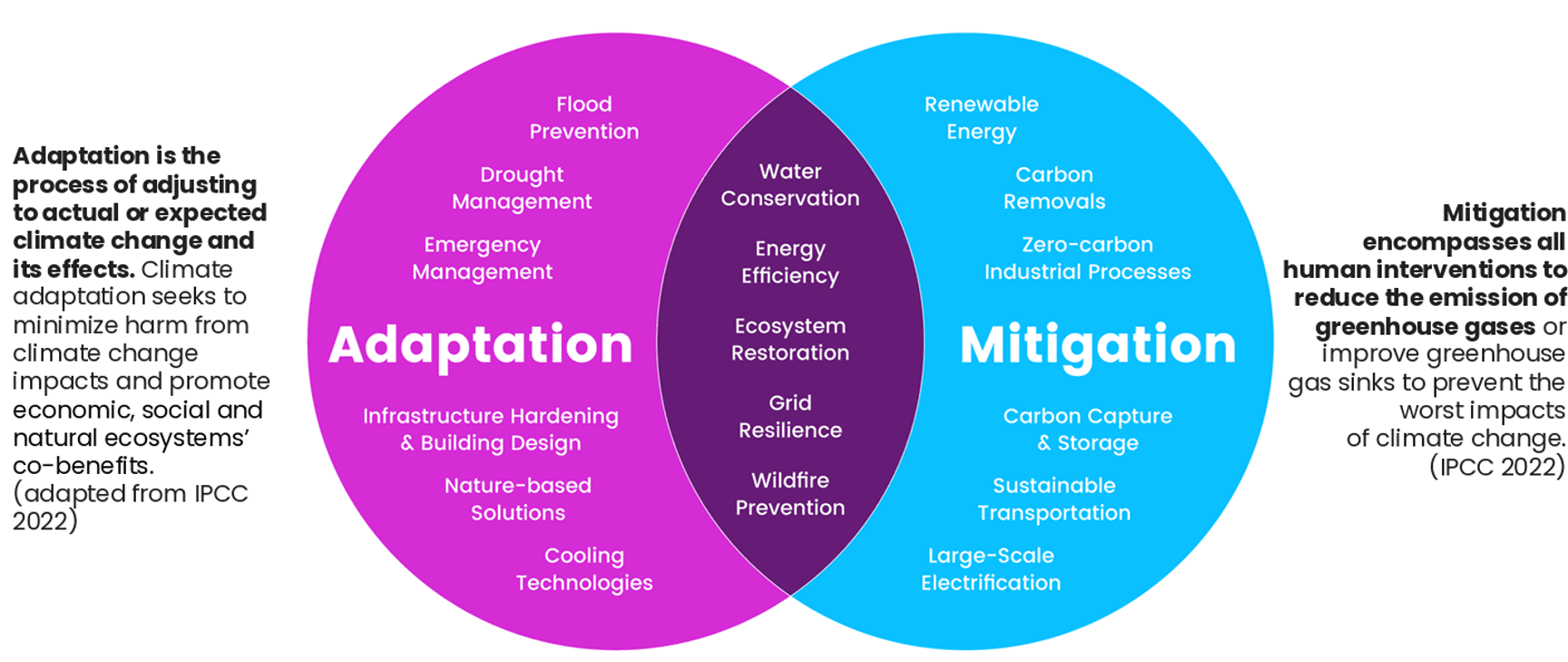

Mitigation and adaptation strategies also include specific initiatives to slow down or reverse the effects of global warming (refer Figure 3).

Figure 3. Adaptation and mitigation opportunities

Source: Tailwind Climate Adaptation Finance Primer.

What We’re Doing Differently

With the world on a trajectory beyond 2°C, understanding and navigating the risks associated with this emerging reality is crucial. In particular, we are:

1. Reassessing Portfolio Risks and Implications

Our mapping of adaptation and mitigation risks and opportunities and understanding of preliminary implications has informed our stewardship agenda for the period ahead. In some cases we are seeking clarification of specific risks. e.g. safeguarding or insuring assets in locations with higher risk of damage or disruption.

2. Refining our Stewardship and Engagement Priorities

We are constructively engaging with companies around opportunities to improve their adaptation and mitigation strategy, including managing climate-related impacts.

3. Positioning for Opportunities

We are integrating these insights to position our portfolios in response to these material risks and opportunities. This includes assessment of both headwinds (e.g. rising cost inflation) and tailwinds (e.g. rising demand for niche products or services).

The climate investment narrative has shifted from ‘if’ to ‘how much’ and ‘how fast’. Portfolio resilience now requires a forward-looking understanding of both climate impacts and adaptation dynamics. We are sharpening our research to reflect this new reality and to ensure we continue to deliver value in an era of accelerating environmental change.

+++

[1] Source: https://wmo.int/news/media-centre/wmo-confirms-2024-warmest-year-record-about-155degc-above-pre-industrial-level.

[2] Source: https://soe.dcceew.gov.au/overview/pressures/climate-change-and-extreme-events; We note that some physical events may have uneven impacts across regions, including some regions, such as Queensland, projected to experience potentially decreasing frequency and increasing severity of cyclones; whereas other risks, in particular, chronic risks are projected to increase in both frequency and severity.

[3] Source: https://www.ipcc.ch/assessment-report/ar6/.

[4] Source: https://unfccc.int/. The Paris Agreement is a legally binding international treaty that aims to limit global warming to well below 2°C with efforts to limit it to 1.5°C through national commitments to reduce greenhouse gas emissions, enhance climate resilience and provide support for developing countries. In 2015, 195 countries signed this agreement; and as of March 2025, there are currently 196 countries and the European Union who are signatories, representing an estimated 85-90% of global greenhouse gas emissions (following the withdrawal of the United States – which accounts for an estimated 15% of global emissions – by executive order in January 2025). In 2018, the Intergovernmental Panel on Climate Change (IPCC) published a special report noting that limiting the global temperature increase to 1.5°C above pre-industrial levels would significantly reduce the risks and impacts associated with climate change compared to an average increase of 2°C. This included lower levels of biodiversity loss, sea-level rise and extreme weather events such as heatwaves and more frequent and severe storms.

[5] Source: https://www.pm.gov.au/media/press-conference-canberra-12may25.

[6] Source: https://australianadaptationdatabase.unimelb.edu.au/.

[7] Source: https://www.nature.com/articles/s41586-025-08751-3.

0 Comments