Investors chasing yields of at least 6% from select investment grade bonds should pause and consider if they are getting a sufficient return for the level of risk taken. In many cases, it’s likely an actively managed diversified credit strategy could generate similar yields at a lower level of risk.

Recent appetite for 20-year paper appears to be driven in part by private wealth managers and others aiming to lock in 6% plus yields by cherry picking direct bond investments, with price technicals and credit fundamentals taking a back seat. The phased abolition of bank hybrid securities in Australia is also adding to demand, as domestic income-hungry investors seek alternative holdings for their portfolios.

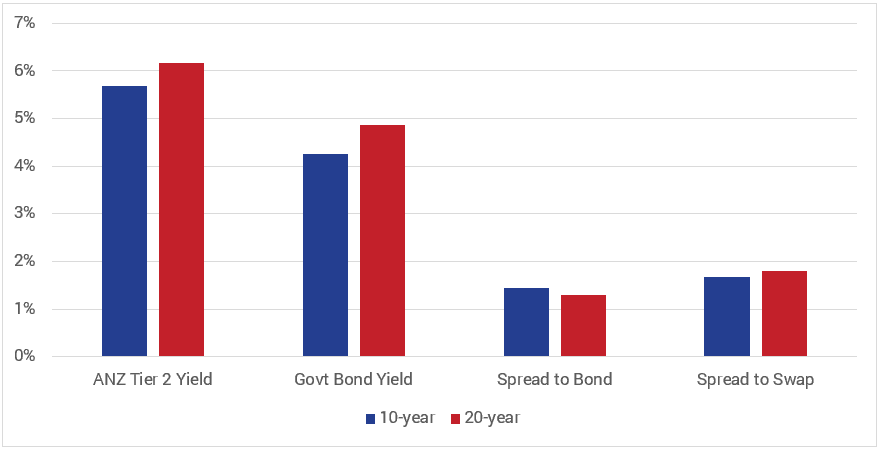

An over-eagerness to reach the “magical” 6% yield was evident in two recent issues. ANZ Group issued a Tier 2 15-year non-callable 10-year (15nc10) bond in August this year at a credit margin of 168bps and a Tier 2 20-year bullet at 180bps. The spread to swap compensation of just 12bps for the latter tranche appears insufficient for the additional 10 years in tenor extension (refer Chart 1).

Chart 1: Chasing yield is a common mistake: How the recent ANZ Tier 2 bond issue stacks up

Source: Yarra Capital Management

Likewise, Electricite De France (EDF) in August issued a 10-year kangaroo bond at 160bps and a 20-year tranche at 220bps. Once again, the 60bps credit spread compensation for the 20-year investment, albeit better compensation than offered by ANZ, still looks insufficient for the tenor extension.

Reality check

Short memories are at play. Investors only need to think back to 2022 to remember what higher interest rates can do to higher duration securities, especially those issued at tight spreads for the tenor. Following a post issue bond rally, the ANZ and EDF bonds are currently in the money, but if a similar increase in interest rates and credit spreads to 2022 occurs in coming years, there would be a significant income loss for holders of both the 20-year ANZ and 20-year EDF bonds.

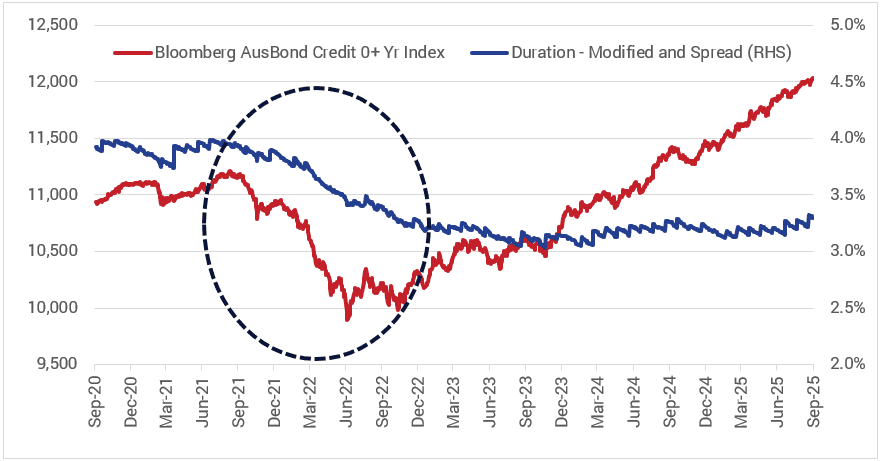

The AusBond Credit Index declined approximately 11% from peak to trough over the course of 2022 with an average credit rating of A+ and interest/spread duration of approximately 3.5-years (refer Chart 2). If interest rates rose by a similar magnitude today, the valuation decline of the ANZ (A-) and EDF (BBB+) 20-year bonds could be three to four times that experienced by the AusBond Credit Index due to their much longer duration and slightly weaker credit quality.

Chart 2: Impact of rate hikes: how the Bloomberg AusBond Credit Index performed in 2022

Source: Yarra Capital Management

In addition to the pricing technicals, it appears weaker credit fundamentals are also being overlooked. For example, EDF has the added complication that it is owned by a highly indebted French Government and a history of being partially privatised. If privatised, its standalone credit rating would fall significantly, with bondholders left unprotected due to the absence of a relatively standard change of control clause requiring the bonds to be redeemed at par.

Times have changed

Prior to this year’s cuts in official rates, it was not necessary to take the same level of duration risk as today to generate a 6% or more yield from 5- to 10-year investment grade bond investments. But the environment has changed and some people appear to be jumping at 20-year paper without considering risk-adjusted returns.

Importantly, investors don’t have to cherry pick direct bonds to receive a running yield of around 6%. In this current environment, a well-managed and highly diversified credit fund can achieve the magical 6% figure and generally a total return in excess of 6%, with minimal interest rate duration and more appropriate spread duration. They can also achieve that outcome while maintaining a strong focus on risk management.

Such a portfolio typically holds more than 100 securities drawn from a wide opportunity set, including corporate bonds, structured credit, some private credit and syndicated loans. Moreover, the portfolios run spread duration risk of three to four years, much lower than that of standalone 20yr bonds, retains investment grade credit quality and is liquid.

In other words, investors with a portfolio of this nature may be exposed to less underlying risk than direct investors with a concentrated parcel of corporate bond holdings. And they may not sacrifice anything in return by opting for an actively managed fund over direct investment in longer-dated bonds.

0 Comments