Volatility in the oil market in recent years provides another salient reminder of the perils of ‘this time it’s different’ thinking.

Some experts have variously called the “death of oil” – Goldman Sachs called for $20 oil in Sept 2015, only to be surpassed by Standard Chartered’s $10 prediction in Jan 2016) – but a much greater group called in effect for the ‘death of oil price volatility’. Comfort and complacency guided the view that oil was ‘range bound’ given the emergence of US shale supply and weak global demand, and that prices were likely to move in a ±10% range. No sooner had this become comfortable thinking than it was proven to be completely wrong.

While this year’s +20% rally in the Brent oil price (YTD average) has caught many by surprise, in some respects we are surprised that they are surprised:

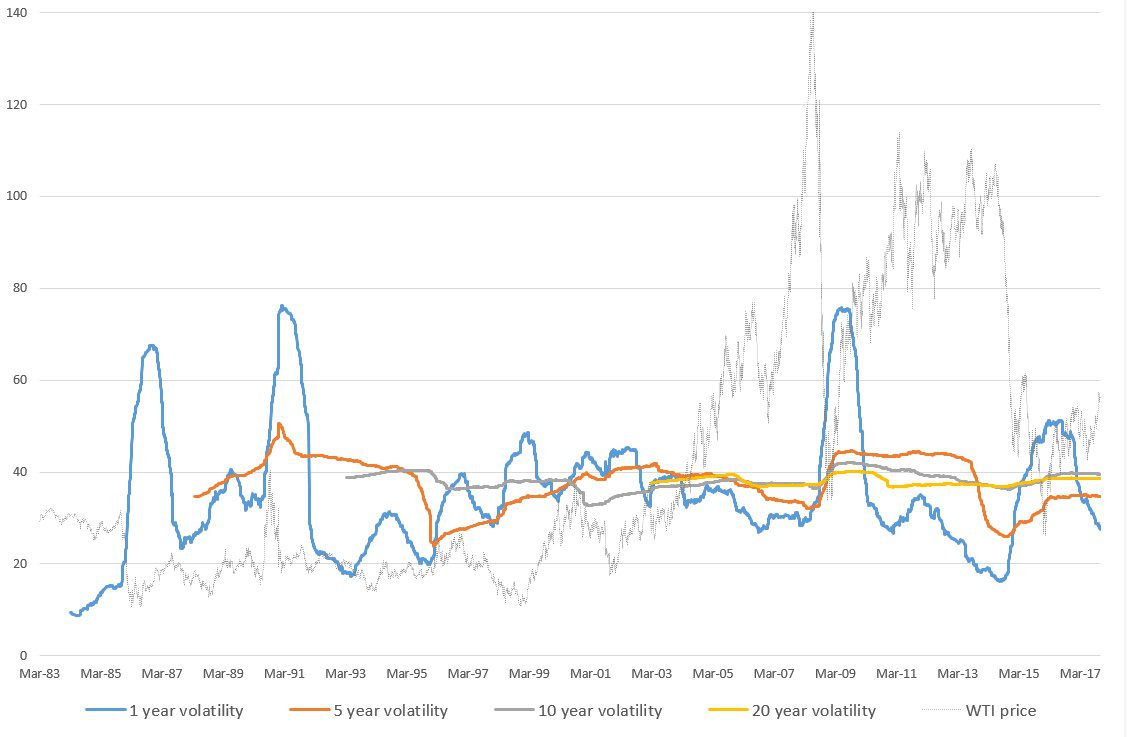

- Over the last 20 years oil has had an annualized volatility of 40%1 (see below chart), so it was highly unlikely to stay in the ±10% range bound position for too long

- Oil and Gas capex has slumped by 35% from the peak2 which has been enough to push the market into deficit

- While OPEC doesn’t carry the weight it used to, ‘self-interest’ and ‘desperation’ suggested tighter production limits were inevitable

- Geopolitical issues were largely ignored with the view that US shale was a shock absorber

Electric Vehicles (EVs) are fascinating and will grow sharply off a small base, but will have minimal impact in the near term since:

- There are approximately 1 billion cars currently in circulation

- Global EV sales are currently less than 1% of total cars sold, and the total stock on the roads is below 2%

- Aggressive EV roll-out scenarios (e.g. 10% of sales in 2025) would only displace about 1% of total oil demand3

Oil Price Volatility

It’s now clear that the view that oil was range-bound and volatility would remain low was a brave one. Our portfolios continue to be long Origin and Santos and appropriately positioned for a rising oil price environment.

Interestingly it appears that a similar view currently exists around equity markets not being volatile, with the VIX at startling levels below 10 (almost the lowest on record). Maybe this time it isn’t different….

0 Comments