The volatility currently seen in bond markets is being fuelled by a combination of macroeconomic forces. In the U.S., ballooning fiscal deficits and a new $3.8 trillion tax bill are putting upward pressure on long-term interest rates. At the same time, foreign demand for U.S. Treasuries appears to be weakening. Central banks are reducing interest rates, yet are constrained in their influence over longer-dated bonds. Meanwhile, Australia faces a decade of projected deficits of its own, and our yield curve continues to respond more to global forces than domestic settings.

These pressures are driving significant steepening in the yield curve – the difference between short- and long-dated bond yields. Steepening curves allow skilled credit managers to adjust risk exposure and capitalize on price differences.

In this environment, extending the maturity of our bond holdings has become more appealing, particularly given longer-term bonds can offer stronger price gains as they approach maturity – a dynamic we term “rolldown.” At the same time, we’re also seeing anomalies in credit spreads, where less sophisticated investors are prioritising yield over relative value, creating pockets of possible mispricing. This is where active management proves its worth. Passive bond funds are bound by index rules. They cannot reposition for anticipated curve moves, nor can they selectively add risk when prices dislocate.

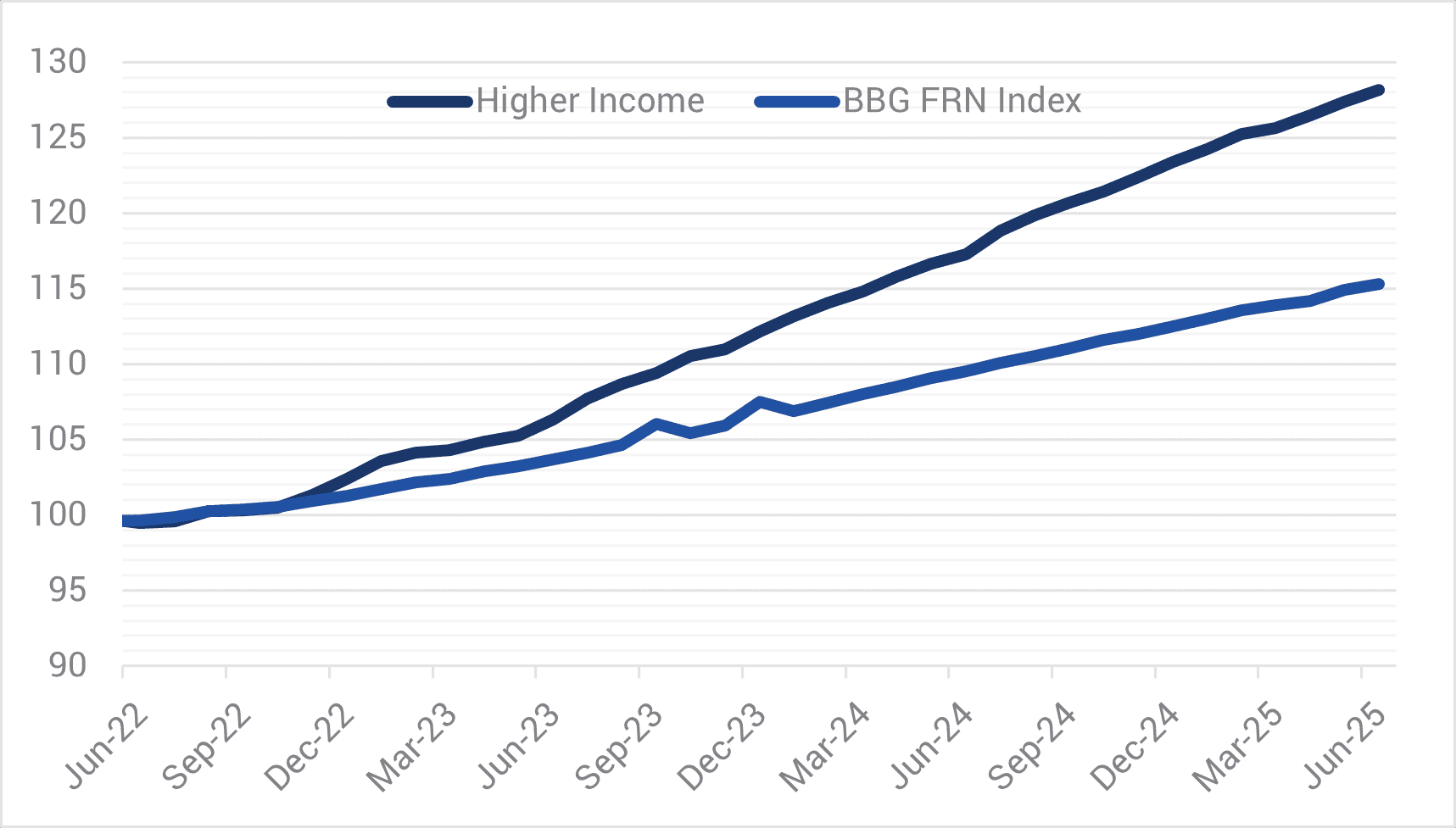

Given the Bloomberg FRN Index is more highly rated (average AA- compared to BBB) with shorter spread duration (~two years compared to ~three), the Yarra Higher Income Fund (HIF) is well placed to outperform during risk-on periods (refer Chart 1). However, HIF’s outperformance during certain risk-off periods demonstrates the potential benefits of active management. HIF outperformed the index through 2022 in an environment of both higher bond yields and credit spreads and more recently in April 2025.

Outperformance in April provides a recent example of how nimble decision-making up and down the curve may contribute to risk adjusted returns. While the FRN Index posted a negative excess return of 11bps compared to the RBA Cash Rate, HIF posted a positive 32 bps excess return despite credit spreads widening by 20-30bps over the month.

In April, we started the month expecting volatility around geopolitical events, which prompted us to lift cash levels and position our portfolios with higher overall interest rate duration. Crucially, we also implemented this with a steepening bias or, in other words, a view that long-term interest rates would rise faster than short-term rates. By focusing our exposure on the front of the curve, or short-term bonds, and being underweight long-term bonds at the back end, we were well-positioned when the long end sold off sharply while the short end remained stable.

Chart 1 – Cumulative Return – Yarra Higher Income Fund v. Bloomberg FRN Index

Source: YCM/BBG, June 2025.

In terms of stock selection, April also presented some fantastic buying opportunities for us to take advantage of spread widening and add high-quality credit exposures at discounted levels. One such name was the USD-denominated Perenti 2029 bonds, an issuer we had previously sold at tight spreads of BBSW+180bps and were able to buy back ~200bps wider (BBSW+380bps). Credit spreads have since contracted ~100bps from these wides, providing a tidy return on investment.

While our portfolio positioning has not changed markedly from 12 months ago, these two recent examples show how we’re actively managing nimble, benchmark-unaware portfolios that are more ‘all-weather’ credit in nature. Our April performance, in which both Yarra’s Enhanced Income Fund (EIF) and Higher Income Fund (HIF) posted positive absolute returns, underscores the value of our approach. Our strategy came together as a result of preparation, speed, and conviction, none of which are available to passive strategies.

Looking beyond the tactical wins, and the case for active credit is supported by the broader macro context. While spread volatility continues, outright yields in the front and mid-parts of the curve have held steady. That means the income on offer remains attractive – and investors are simply being rewarded through a different mix of risk premia. The flexibility to shift between spread and rate risk allows us to preserve capital and position for growth, depending on where the market is offering best value.

It’s a powerful setup. Investment-grade credit today is offering yields that, on a 12-month view, look comparable to long-term equity market returns – but without the same drawdown risk. Across the spectrum, private credit looks less compelling: the illiquidity and default risk required to justify allocations to private credit simply aren’t being compensated in this environment.

Looking ahead, we see the drivers of this opportunity set – fiscal overreach, inflation variability, and steepening curves – as persistent features of the bond market over the next 6 to 12 months. We believe this is a sweet spot for credit investing. High running yields and steeper curves, allowing active positioning across durations are compelling and signal the era of ‘buy everything and wait’ in fixed income is over. Today’s market rewards clarity of view, agility of execution, and a willingness to lean into volatility when others step back.

0 Comments