By Dr Erin Kuo-Sutherland (Chief Sustainability Officer).

Our view on climate change creates a base case for adaptation and resilience

Our analysis of climate science, policy trends and real-world emissions trajectories indicates that the world is not currently on track to meet the goals of the Paris Agreement. The data points to a likely overshoot of near-term net zero pathways, followed by a later, steeper transition, accompanied by more frequent and severe physical impacts. We recently published a paper ‘Reframing Net Zero’, which highlights uneven global policy momentum, rising physical risks, and a delayed but more intense decarbonisation effort.

Despite a delayed transition, net zero still matters for long-term value

Despite the likelihood of overshoot, net zero remains foundational for long-term value: it anchors economic resilience, supports stable markets, and aligns with client and societal expectations. Companies that fail to prepare for decarbonization may face higher costs of capital, regulatory and stakeholder pressure or reduced competitiveness.

However, as companies manage transition risk and invest to decarbonise, we acknowledge that in many cases they are dependent upon shared systemic or structural issues that require policy settings, the right signal and a coordinated approach to unlock solutions (see our recent climate white paper: ‘Where Investors Can Have Impact’).

Our net zero objectives reflect indicative rather than fixed trajectories

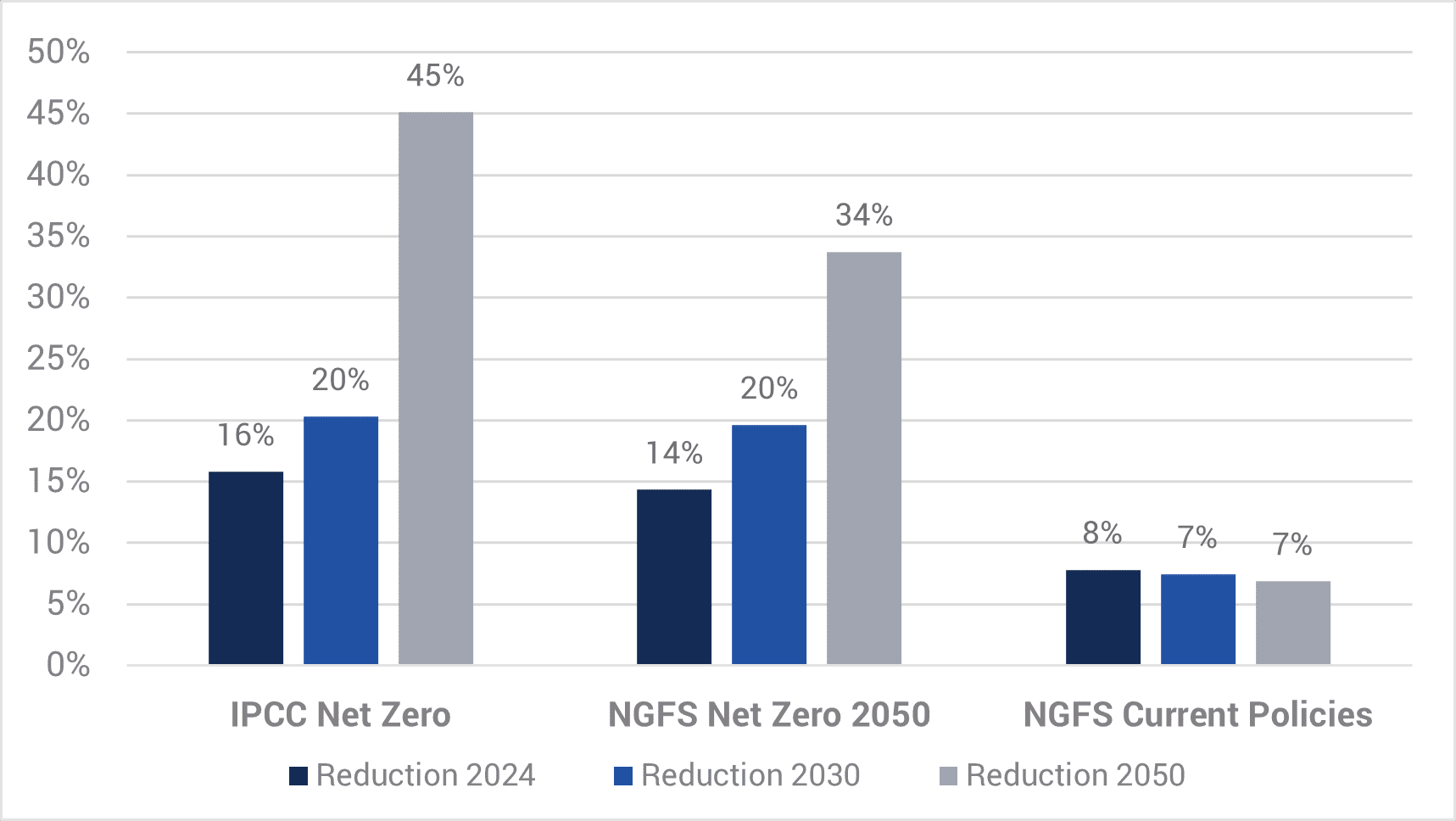

We have modelled net zero Greenhouse Gas (GHG) emissions reduction requirements calculated for Yarra Equities (baseline 2024) as requiring a: 20% reduction by 2030; 45% by 2050 (IPCC net zero scenario); and 20% by 2030 and 34% by 2050 (NGFS net zero scenario).

Figure 1. Net zero modelled emissions reduction requirements (YCM Equities, baseline 2024)

Source: Yarra Capital Management, Dec 2025.

While it is important for us to understand the quantum of emissions modelled under net zero climate scenarios, we see these as directional objectives rather than firm targets. This is because we know that portfolio positions, emissions trajectories of companies, and methodologies for climate data including climate scenarios change over time. And we understand that in order to reduce the carbon liabilities of our portfolio companies, they will need to navigate complex systemic challenges that require coordinated efforts that often impact the broader economy. These directional objectives guide our analysis, engagement and forward strategy but are not portfolio construction constraints.

Climate Objectives and Contingencies

Our objectives are to manage portfolios for a warming world, support an orderly transition, focus influence where investors can meaningfully shift outcomes, and enhance disclosure. We recognise our companies’ and our portfolios’ climate objectives are dependent upon contingencies such as: (i) slow decarbonisation in hard-to-abate sectors; (ii) uneven policy momentum; (iii) expanded reliance on adaptation, resilience and emerging technologies; and (iv) potential regulatory step-changes. Understanding our climate objectives are contingent on broader issues informs our pragmatic, adaptive and resilient approach to climate change.

Our Climate Action Plan: What we will do

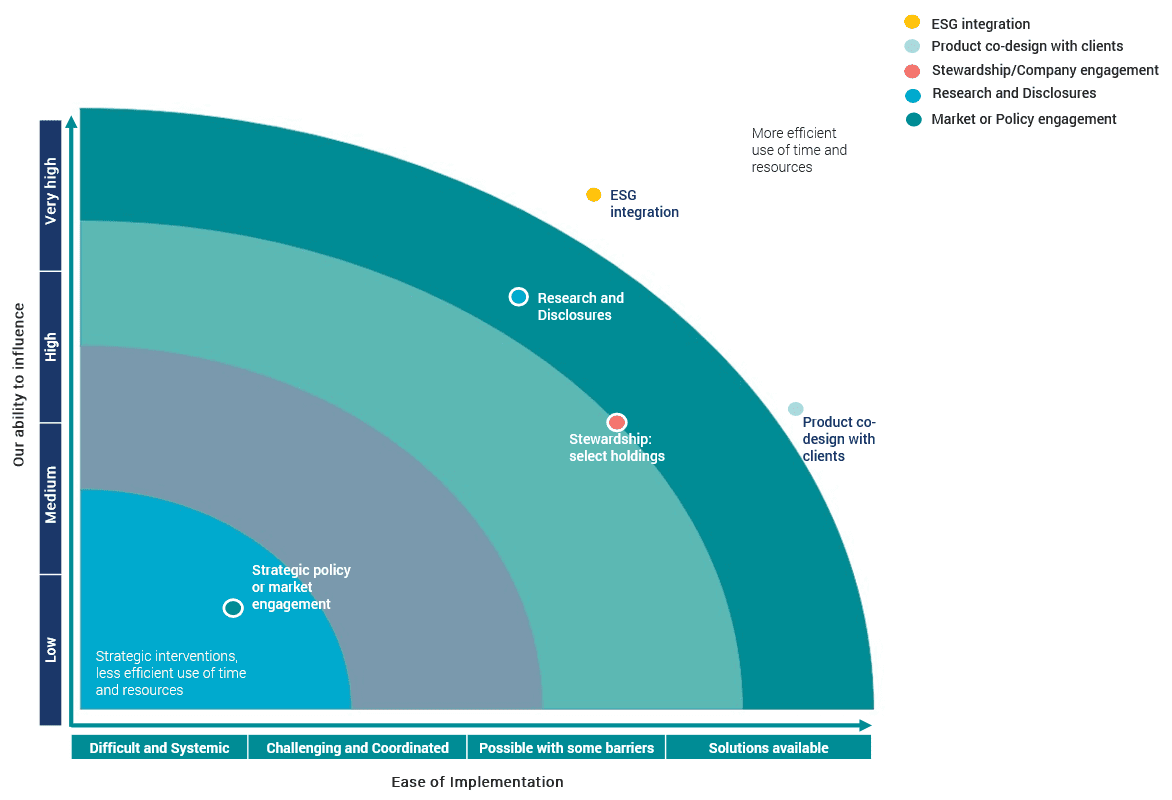

Our Climate Strategy Matrix (refer Fig. 2) summarises our approach to managing climate change, including focusing on where we can have material influence such as through: integrating ESG considerations into investment decisions; working with clients to integrate climate considerations into products; prioritising engagements where we can influence outcomes; continuing to enhance our approach to research and disclosures; and evaluating selectively where it makes sense to engage in broader market or policy advocacy.

Figure 1. YCM Climate Strategy Matrix

Source: Yarra Capital Management.

0 Comments