By Dr Erin Kuo-Sutherland (Chief Sustainability Officer).

Executive Summary

- As Australian investors, we are committed to decarbonising our portfolios and reducing financed emissions. The ability to achieve this is highly interconnected with the broader Australian economy and the way in which it decarbonises.

- Evidence points to Australia falling short of its 2030 net zero targets and 2035 targets being ambitious. Additionally, Australia’s 2050 net zero targets are dependent upon a rapid and increasing decarbonisation trajectory that is highly contingent upon key innovations and policy levers–these are ‘shared structural dependencies’ where individual companies are dependent upon systemic interventions to decarbonise that, in many cases, reside beyond their direct control.

- Within our current listed equity portfolios, our analysis highlights that companies with high potential carbon liabilities (i.e. higher transition risk) are generally exposed to external factors (including the requirement of gas) resulting in narrow scope for stewardship to be an effective tool for moving toward net zero objectives. We are sharply focused on engagement opportunities where companies have meaningful control to decrease emissions, while remaining cognisant of key dependencies.

- This top-down and bottom-up analysis leaves a residual gap where we believe we can advocate for more ambitious transition approaches to climate change. It also informs our expanded focus on understanding physical adaptation and resilience strategies for all companies in our investable universe.

- Additionally, we conclude that outside of direct engagement with select portfolio companies, net zero goals more generally will only be met with coordinated effort to unlock these shared structural dependencies.

Introduction

Climate change is reshaping the investment landscape, with implications for how we manage portfolios. As long‑term investors, Yarra Capital Management recognises that effective climate strategy must combine macro/top‑down context — national and global progress toward decarbonisation — with bottom‑up analysis of portfolio companies and sectors most exposed to transition and physical risks.

Australia is currently unlikely to achieve its climate targets

Australia has legislated a 43% reduction in emissions from 2005 levels by 2030, a 2035 target of 62-70% below 2005 levels and a net zero commitment by 2050. However, as multiple independent bodies have highlighted, achieving these targets remains challenging. The Grattan Institute notes current policy settings are not yet on track to meet 2030 targets without accelerated investment[1]. The Climate Change Authority estimates Australia must triple the pace of emissions reduction from now to 2030 in order to achieve its 43% reduction target[2]. With the recent announcement of the 2035 interim targets, multiple independent bodies including the Climate Change Authority, Grattan Institute and Climateworks have noted that the 2035 targets are feasible but require increased and rapid action and coordinated policy support.

If the 2030 target of 351 MT is achieved, Australia must then cut ~18MT per year from 2030-2050 to hit net zero; almost double the annual reductions expected from 2023-2035. This will require green hydrogen, heavy-vehicle decarbonisation, and emissions sinks (negative emissions).

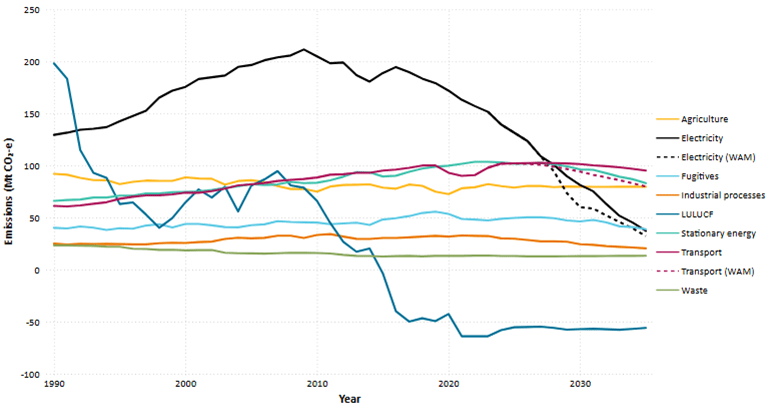

Chart 1: Australia’s 2023 emissions projections, by sector (Mt CO2-e)

Source: Australia’s Emissions Projections DCCEEW, 2023.

Australia has used two primary levers to achieve 27% reductions since 2005[3]

- Emissions reductions to date have been driven by land-based carbon removals and increasing renewables in the Electricity sector.

- To date ‘Land Use Land Use Change and Forestry’ (LULUCF) has been the biggest source of emissions reductions.

- The electricity grid is decarbonising fastest amongst sectors, with renewables expected to exceed 80% of generation by 2035[4]; however, it is likely to fall short of its target of 82% by 2030, bottlenecked by transmission & storage.

- Emissions from Agriculture and Waste have also declined incrementally; however, other sectors have increased or remained net flat. Industrial decarbonisation for high-emitting sectors remains hard‑to‑abate, notably in steel, cement, aluminium, and chemicals.

Global emissions have increased from 33Gt in 1990 to 41Gt in 2005 to 50Gt in 2022. In this period since 1990, we have seen only five periods of negative emissions growth:

- 1992: attributed to slowing industrial activity post the collapse of the Soviet Union;

- 1998: attributed to the strongest El Nino event on record and the Asian Financial Crisis;

- 2009: attributed to the Global Financial Crisis;

- 2015: attributed to China taking significant amounts of coal production offline; and

- 2020: due to COVID.

It seems apparent that, on a global scale, there have yet to be any direct structural changes to drive a downward emissions trajectory. However, some contrary evidence suggests we may be nearing peak global emissions,[5] which could indicate structural trends are on the horizon to support decarbonisation and climate progress.

As Australian investors advocating for the climate transition, it is imperative that we see policies that incentivise electrification and grid decarbonisation, green hydrogen and future fuels, demand side management, industrial process efficiency, and carbon management.

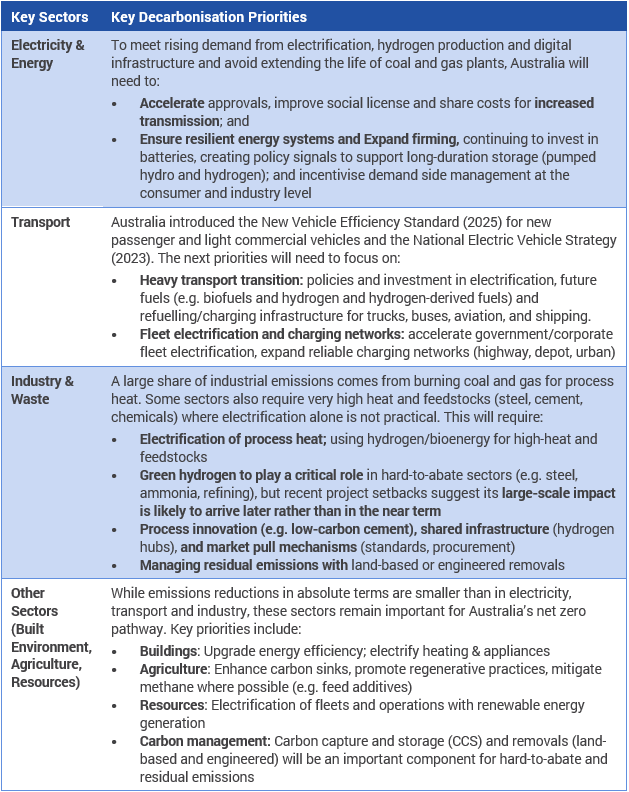

Where do we need to focus our policy efforts?

As Australian investors, if we were to develop a coordinated policy approach to meet Australia’s climate objectives, we would advocate for a policy agenda that accelerates and incentivises electrification and grid decarbonisation, green hydrogen and future fuels, demand side management, industrial process efficiency, and carbon management.

Table 1. Sector-specific decarbonisation priorities to inform policy coordination

Source: Yarra Capital Management, various sources including Climate Change Authority, McKinsey.

These domains represent structural dependencies that Australian companies share. If Australian companies do not see coordinated policy efforts to help unlock these shared structural challenges, it will make it difficult to meaningfully decarbonise.

What we know is the trajectory of decarbonisation must be steep and rapid; however, the maturity and timeframe of available solutions is still somewhat unclear. For example, green hydrogen is widely seen in Australia’s 2024 National Hydrogen Strategy as a central pillar for decarbonising the grid, transport and hard-to-abate industrial processes. However, several high-profile Australian green hydrogen projects have been stalled or scaled back in the last year (2024-2025) as industry challenges emerge.[6] As it stands today, meaningful decarbonisation levers like green hydrogen, biofuels, and carbon capture and sequestration (CCS) require additional incentives and an enabling environment to ensure they are economically viable solutions. The opportunity to ensure Australia’s policy environment is focused on incentivising high value decarbonisation activities will be paramount for industry, investors and the wider economy to meet net zero objectives.

Where do we, as investors, have control to minimise financed emissions?

As Australian investment managers, our climate strategy must assess how individual companies and sectors are positioned against and within this broader context.

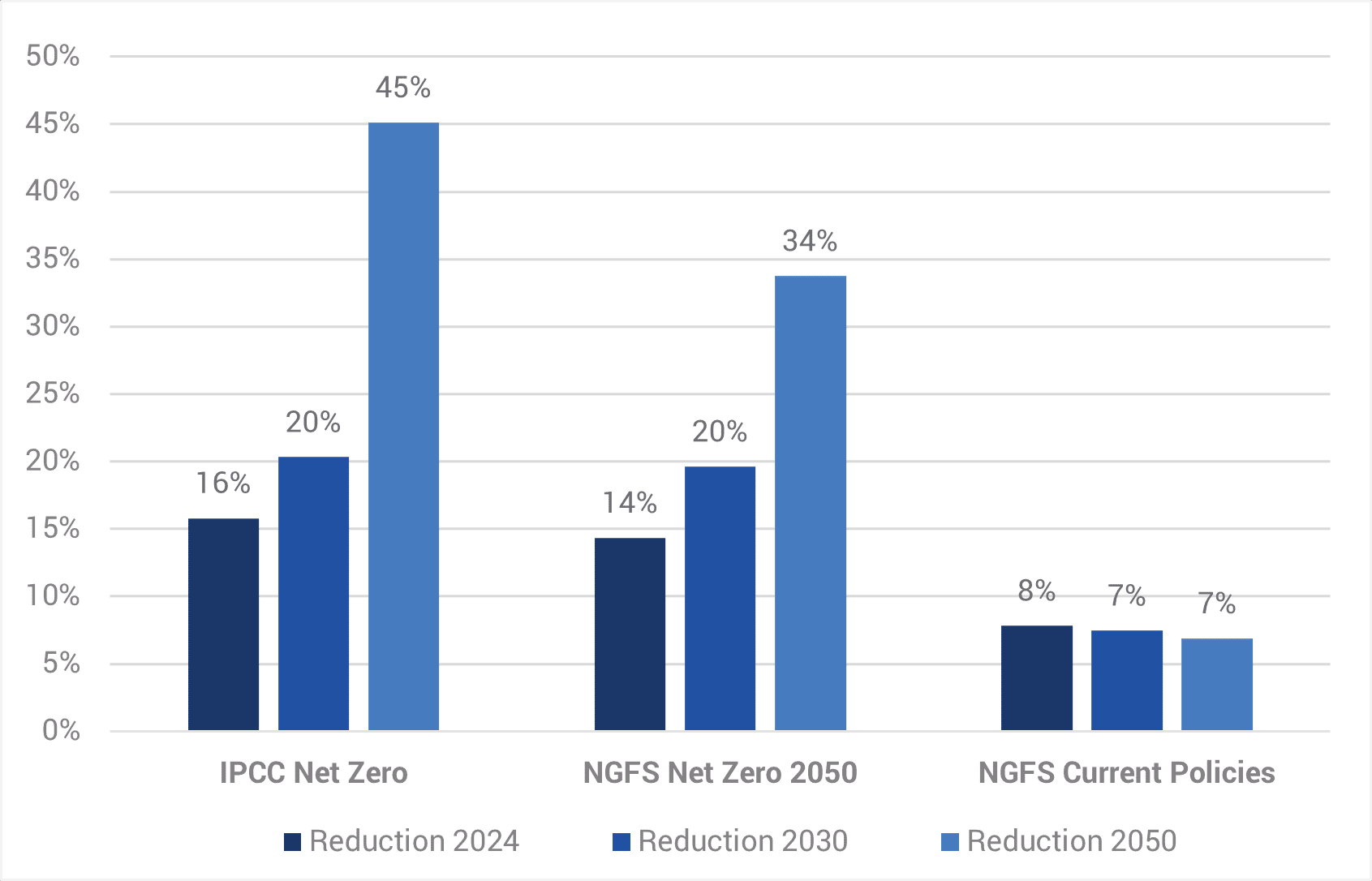

In order to understand how this plays out in our portfolios, we have stress tested two net zero climate scenarios[7] to understand our potential carbon liabilities and quantify our emissions reduction requirements.

Chart 2. YCM Listed Equities emissions reductions requirements: Scopes 1, 2 and 3

Source: Emmi and Yarra Capital Management. Data is for Yarra’s Listed Equities, 2024.

Using the more ambitious IPCC net zero model from a 2024 baseline including Scopes 1, 2 and 3, our emissions reduction requirements would be:

- 2030: 20% reduction

- 2050: 45% reduction

Under this scenario, we identified that approximately six out of 150 listed equities holdings were driving the majority of the potential carbon liability for our portfolios at the time of analysis.

Our analysts evaluated key decarbonisation pathways for these companies. In this process, we sought to differentiate between where the company has a degree of control and where they may be beholden to more systemic or coordinated interventions, or dependencies on other actors to reach their transition goals. The objective of this exercise was to:

- Identify the key levers for these companies to manage their transition risk;

- Understand where engagement or stewardship could be an effective tool by identifying where companies have degrees of control and could be doing more; and

- Inform a pragmatic approach to our climate strategy by focusing our efforts where we believe outcomes are meaningful and achievable and understanding where we may have contingencies, dependencies and residual risk in achieving net zero.

By connecting the top-down picture to the bottom-up realities of portfolio holdings, we can sharpen our stewardship, capital allocation and risk management to align with our investment objectives and pragmatically understand our pathway to net zero.

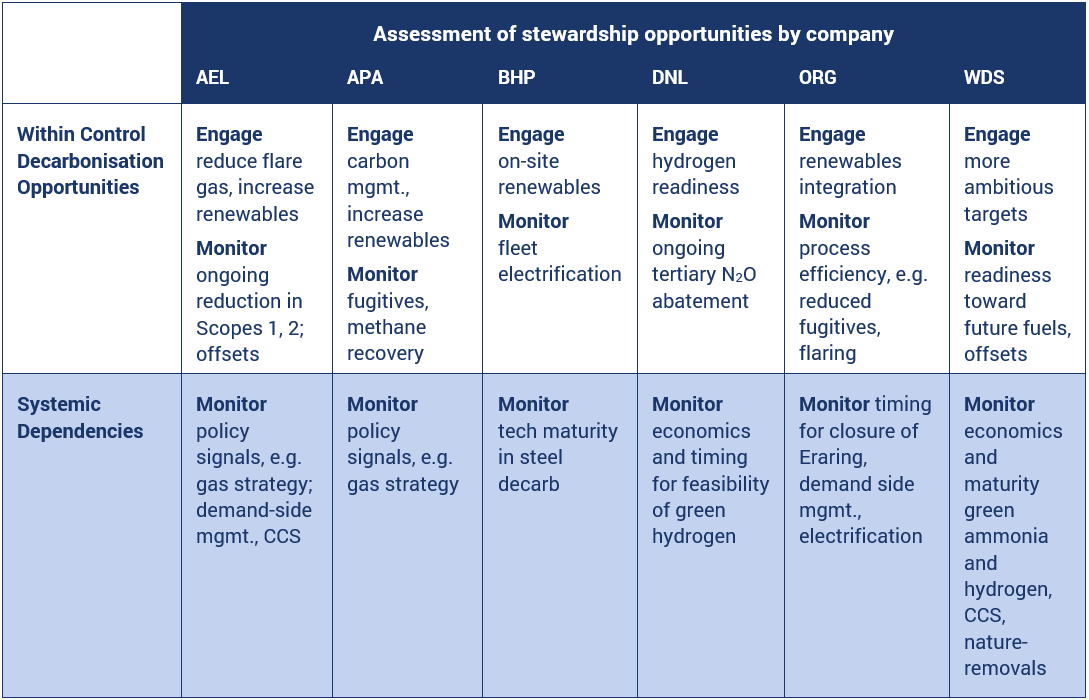

Our bottom-up analysis is summarised below for each of the six companies driving outsized potential carbon liability in our 2024 climate scenario model.

Amplitude Energy (AEL) — Energy

AEL is an Australian natural gas producer, supplying the domestic market only. Its biggest source of greenhouse gas emissions comes from Scope 3, driven by customers burning the gas that it sells. While there is no easy solution for reducing these emissions for a company like AEL, it is balanced by our view on the critical role for gas in Australia’s energy transition and the steps AEL is taking in managing emissions within its direct control.

In our view, AEL is the oil & gas industry leader in decarbonising its operations. The company is net zero for Scope 1 & 2 emissions and is targeting aggressive reductions in gross emissions to reduce its reliance on offsets to achieve this. As a small domestic gas producer, AEL is very reliant on consumer demand for natural gas and has limited opportunities to influence demand levels.

We believe gas will be important to the energy transition as a firming fuel for renewable energy generation, but long-term AEL operates in a sunset industry. We see opportunities to engage with the company on plans to reduce flare gas and increase renewable electricity use but recognise the ability to influence end-user gas demand is limited.

APA Group (APA) — Utilities

APA is Australia’s largest owner of gas transmission infrastructure which facilitates the flow of gas up and down Australia’s East and West coasts. It also owns and is developing both gas-fired generation plants and renewables across Australia.

The majority of APA’s emissions are Scope 1 sourced from natural gas combustion from compressors that operate its gas transmission pipelines, fugitive methane emissions from its pipelines and the operation of gas-powered generation. APA is consistently reducing pipeline related emissions towards its 2030 30% reduction target (from 2021, including underlying growth) through electrification of compressors and methane recoveries through valve and seal upgrades. We also expect the emissions intensity of APA’s electricity generation activities to fall materially over time as new renewable assets are added to their portfolio.

From a stewardship perspective, we feel comfortable with the actions APA has within its control to reduce its direct emissions and will continue to engage to monitor progress. We will also engage on their approach to carbon management for residual emissions.

BHP Group (BHP) — Materials

BHP’s mining operations cover multiple jurisdictions, commodities, and mining techniques that all influence its emissions intensity. Its largest source of emissions by far is related to its customers processing iron ore and metallurgical coal that it mines into steel (Scope 3).

Displacement of fossil fuels for electricity generation with renewables and electrifying its mobile fleet to reduce diesel consumption are important pathways for the company to decarbonise. The company’s medium term decarbonisation goals are realistic, but there remains scope for advocacy for more aggressive carbon reductions in our view. Ultimately BHP is reliant on technologies that are not yet fully developed or economic to achieve its 2050 net zero target. Removal of carbon emissions from global steel making is critical for long-term demand for BHP’s iron ore, and the company is seeking to influence customer demand through seed investment in emerging technologies. Conversely the company’s copper operations are critical to help support the broader energy transition.

Dyno Nobel (DNL) — Industrials

DNL has elevated GHG emissions primarily due to its production of ammonium nitrate-based explosives and industrial chemicals. The bulk of emissions arise from the ammonia manufacturing process, which uses natural gas (methane) as a feedstock and a series of chemical reactions which emit nitrous oxide (N₂O), a greenhouse gas with higher potency than CO₂. We note that DNL has successfully reduced Scope 1 & 2 emissions in recent years, largely due to portfolio changes (sale of Waggaman, Gibson Island cessation) with further emissions reductions possible pending the Phosphate Hill outcome expected in late 2025.

Outside of these site exit-driven emissions reductions, in the near term, DNL is rolling out tertiary abatement technologies across its nitric acid plants (Moranbah and LOMO) to materially reduce N₂O emissions. These systems are commercially proven but require capital investment and plant-specific retrofits. Longer-term DNL will need to substitute green hydrogen for natural gas, which points to a key dependency on green hydrogen becoming cost competitive, something that looks challenging over the next decade.

We believe our stewardship efforts are best focused on monitoring DNL’s tertiary N2O abatement progress and understanding its approach to hydrogen readiness and investment in pilot programs. We believe these are the two key pillars to helping DNL manage transition risk and position itself for when green hydrogen becomes viable.

Origin Energy (ORG) — Utilities

ORG’s two major businesses include its wholly owned Energy Markets business and its 27.5% stake in Australia Pacific LNG (APLNG). The vast majority (84%) of ORG’s 16Mt of Scope 1 & 2 emissions in FY25 came from its Eraring coal power station within its Energy Markets business which provides up to 25% of New South Wales’ electricity needs. The asset is scheduled for closure by August 2029, which will form another key step in the decarbonisation of Australia’s electricity grid; however, given its importance to the grid underpinning energy access and affordability, ultimately system stability considerations and State government requirements will determine its closure date. This is a key area we continue to monitor.

As a major supplier of gas to domestic households and businesses and its stake in LNG exporter APLNG, ORG’s Scope 3 emissions far outweigh its direct emissions. We expect demand side efficiencies, behaviour changes and electrification will reduce these emissions over time. However, we also note the key role that gas will play in displacing less efficient coal generation and in firming the influx of renewables that facilitates decarbonisation through electrification.

Woodside (WDS) — Energy

WDS is Australia’s largest producer of oil and gas, and as such its largest source of emissions comes from its customers’ combustion of these hydrocarbons (Scope 3). It also generates material emissions in the extraction and processing of oil and gas (Scope 1).

WDS’s pathways to contributing to a decarbonised economy are two-fold. Natural gas supports renewables by providing flexible capacity and firming, and WDS’s focus must be on reducing the carbon intensity of its resource extraction operations. The company’s ‘Design Out, Operate Out, Offset’ strategy is targeting a 30% reduction in Scope 1 & 2 by 2030. We see opportunities to monitor and engage with the company to push for stretch goals given many of the reduction opportunities are based on existing technologies.

Longer term, WDS must use its balance sheet strength to diversify into low/zero carbon fuels such as green ammonia and hydrogen. The recent investment in Beaumont Ammonia as part of a $5bn new energy projects strategy is a start, however lack of customer demand for green hydrogen at prices required to support project economics underlines the challenges WDS will face progressing its operations and value chains to net zero.

Our bottom-up analysis highlights that individual companies can continue to reduce emissions with available technologies and opportunities well within their direct control, e.g.:

- Operational improvements to reduce emissions (within control): this includes readily available upgrades that reduce energy waste/consumption per unit of output or reduce emissions, e.g. valve and seal upgrades (APA) and minimising flaring and venting (WDS)

- Process emissions abatement (within control): this includes destruction or avoidance of emissions, such as N2O, e.g. DNL

- On-site renewables and storage, behind the meter (within control): including microgrids or facility-level renewable energy generation and storage; all

Equally, our bottom-up analysis highlights the same thematics we see in our top-down research: in many cases, companies are dependent upon broader systemic transformations to meaningfully decarbonise. We know that even deep and clear engagement with, in this case, six companies, is not going to decarbonise the system. So, we are still left with understanding the broader systemic dependencies and shifts required.

Defining what is within the company’s control and where they are dependent upon external factors to decarbonise is a helpful lens in helping us prioritise where higher value stewardship opportunities exist (Table 2).

Table 2. Stewardship opportunities in portfolio companies driving outsized carbon liability

Source: Yarra Capital Management.

When it comes to climate change, where can investors have impact today?

Our research informs our climate strategy, notably guiding where we believe we can have the greatest impact. In pursuit of net zero, we have identified five key actions that we can take today, prioritised by our ability to have influence and relative ease of implementation (Figure 1):

- ESG integration, focused on ensuring we are applying rigorous and informed assessments of climate risk calibrated against portfolio objectives, company-level risks and opportunities, and outlook on the pace of change related to structural dependencies. Where appropriate, we will continue to embed our understanding of climate risks into investment decisions, focusing on material carbon liabilities and exposure to physical risk, particularly where we see a material impact on value. This builds on our core capability of integrating material risk and opportunities into valuation and portfolio analysis.

- Capital allocation, including working with clients to meet their responsible investment objectives and co-design investment solutions that align with a just climate transition. We work with clients to implement strategies that align to their responsible investment mandates and objectives, and we are exploring thematic strategies with clients.

- Targeted stewardship for holdings with outsized potential carbon liability, i.e. higher transition risk, and where we believe companies can do more either within their direct domains of control (transparency, accountability, ambition, efficiency); or indirectly via engagement and stakeholder coordination. We can hold companies accountable for transparency, alignment of capex with credible pathways, operational efficiencies and innovation. We observe that most companies with high transition risk are already leaning into these levers; but where companies could improve, we can be very targeted in identifying where they can be more accountable.

- Potential policy advocacy where appropriate and highly valuable. Where pragmatic and feasible, we can direct our efforts toward high-value collaborative engagement with clients, companies or wider stakeholders to address the transformation of shared systemic dependencies that will help companies accelerate decarbonisation.

- Research and disclosures including being transparent with clients and other key stakeholders about what we can and cannot control. As investment managers, we are aware of the responsibility we hold to manage climate risk and play a constructive role in Australia’s climate transition. We can set clear net zero targets and interim emissions reductions pathways with contingencies about future portfolio positions and noting key structural dependencies. Our approach to climate strategy and other published research is to be transparent and clear about what we can and cannot control and where we must acknowledge uncertainty.

Figure 1. YCM Climate Strategy Matrix—What can we do? What should we do?

Source: Yarra Capital Management.

Conclusion: A climate strategy guided by transparency and pragmatism

We recognise that portfolio‑level risks are concentrated in the sectors most critical to Australia’s decarbonisation. While some companies may exceed their implied carbon budgets under net zero pathways, the solutions extend beyond the corporate sphere.

For investors, this calls for managing portfolios with a clear view of systemic constraints, engaging actively with the companies and issues that matter most, and contributing to the policy and system-level changes in a highly strategic way to deliver benefits that extend beyond our portfolios.

[1] Podcast: Should Australia abandon the Paris Agreement

[2] 2024 Annual Progress Report

[3] DEECW GHG inventory updates, Dec 2024

[4] AEMO | 2024 Integrated System Plan (ISP)

[5] https://www.emmi.io/newsroom/white-paper-carbon-reverse?

[6] https://grattan.edu.au/news/whats-hampering-hydrogen/

https://www.dcceew.gov.au/sites/default/files/documents/national-hydrogen-strategy-2024.pdf

[7] Aligned to our 2024 climate disclosures in our 2024 Group Sustainability Report, we adopted the Intergovernmental Panel on Climate Change (IPCC) and the Network for Greening the Financial System (NGFS) net zero scenarios to inform net zero emissions reduction requirements from a 2024 baseline. This includes assumptions that point in time company emissions remain flat over the projected time frames and portfolio positions remain unchanged. We acknowledge that neither of these assumptions will be the way our actual financed emissions progress; however, for the purposes of forward modeling, we have chosen these conditions as a best endeavours approach.

0 Comments